Crypto

Some Strategies to Reduce Cryptocurrency Investment Risk

To reduce cryptocurrency investment risk learn the strategies mentioned in this article

The process of purchasing and holding digital money that is protected by blockchain technology and can be used for online transactions or as a value store is known as cryptocurrency investment. Cryptocurrency investment can take a variety of forms, including opening a cryptocurrency Roth IRA, investing in cryptocurrency funds or companies, or purchasing cryptocurrency directly from a crypto exchange or broker-dealer. The prices of digital assets can fluctuate significantly and are affected by a variety of factors, including supply and demand, regulation, innovation, and competition, making cryptocurrency investment risky.

- Using Leveraged Options on Crypto ETF

- Spread out your Crypto Portfolio

- Try to Implement the Stop Less Strategy

- Only invest what you can afford to lose

Using Leveraged Options on Crypto ETF:

The main strategy for managing the risk of cryptocurrency investments is to leverage options on cryptocurrency Exchange Traded Funds (ETFs). For instance, if you have a bullish outlook on Bitcoin and invest a lot in this digital asset, you need to monitor instruments like BITO closely and buy put options strategically. This strategy enables you to protect yourself against unexpected reductions in the price of cryptocurrencies.

Spread Out Your Crypto Portfolio:

You can reduce the impact of potential losses on a particular asset by spreading your investments across different cryptocurrencies. Diversification helps you to avoid relying too much on a single coin or project, as cryptocurrencies can be volatile and unpredictable. You can increase the chance of having some investments perform well even if others underperform by diversifying your portfolio. This strategy works well because it balances the risk and potential reward, letting you participate in the overall growth of the cryptocurrency market while minimizing the impact of individual coin fluctuations.

Try to Implement the Stop Less Strategy:

To limit possible losses if the bitcoin market falls, utilize a stop-loss technique. In the event of a protracted market slump, this technique can help me limit unanticipated losses by setting an automatic price at which my investments will be liquidated. By establishing this cap, you may ensure that you always have the upper hand and reduce the amount of money you stand to lose.

Only Invest What You Can Afford to Lose:

Only investing what you can afford to lose is the golden rule for cryptocurrency investing. Here’s why this strategy works well. Cryptocurrencies are very volatile they can soar or crash in a short time. The prices can go to the moon one day and then drop the next. Because of this unpredictability, it’s very likely to lose a lot of money fast. To safeguard yourself, you can only use money that you don’t need for your regular expenses or important goals like paying rent or saving for retirement. This way, if you lose money, it’s not a disaster. It won’t affect your ability to pay your bills or achieve your important financial goals. This strategy helps you to relax. It’s easy to get carried away by the hype of potential profits, but by only using the money you can afford to lose.

Crypto

How the Fed's Rate Cuts Could Shave Millions in Stablecoin Issuer Income

:max_bytes(150000):strip_icc()/INV_StablecoinsonaScreen_GettyImages-1241851893-48842e0b8e6d448ba2300a3c0c5d1423.jpg)

Key Takeaways

- The Federal Reserve’s recent decision to cut interest rates will lead to lower revenue for stablecoin issuers, according to a new cryptocurrency industry report.

- Issuers of stablecoins have held U.S. Treasurys as a way to earn a return on the reserves backing the digital assets they issue.

- Stablecoin providers hold nearly $125 billion of U.S. Treasurys, and each 50 bps rate cut is expected to lead to a $625 million drop in annual interest income derived from these assets.

- If rates continue to fall, as expected, stablecoin providers may need to look into alternative reserves to back their digital assets, a crypto industry executive forecast.

Stablecoin issuers could be looking at lower income as the Federal Reserve (Fed) kicked off its first rate cut cycle since 2020.

Each 50 basis point cut by the Fed could lead to a $625 million drop in total annual interest income for stablecoin issuers, according to a new report from digital asset data provider CCData.

Those hits could quickly add up as the Fed itself expects cuts totaling 50 basis points by the end of this year, and another 100 basis points by the end of next year.

Why Would A Rate Cut Affect Stablecoins?

Stablecoins are cryptocurrencies whose value is pegged to another cryptocurrency. Some of the most popular stablecoins have their value pegged to the U.S. dollar and keep a reserve in cash or equivalent investments—often U.S. Treasurys—to maintain that peg.

Centralized stablecoin providers, such as Tether (USDTUSD) and Circle (USDCUSD), have relied heavily on their holdings of U.S. Treasurys earning interest over the past few years as high interest rates drove up Treasury yields.

U.S. Treasurys make up the vast majority of reserves held by stablecoin issuers, at just over 80%. This amounts to holdings of nearly $125 billion worth of Treasurys.

Tether, the largest stablecoin by market cap, alone holds $93.2 billion worth of U.S. debt, which accounted for much of that digital asset company’s $5.2 billion of profits in the first half of 2024, the CCData report said.

Bitcoin.com Director of Engineering Andrei Terentiev speculated on social media that lower interest rates could eventually push stablecoin providers and other financial institutions into riskier assets in an effort to earn a return on their reserves.

“With lower yields on safer assets, institutions often shift their focus toward ‘risk-on’ assets,” Terentiev posted on the platform X. “Think stocks, crypto, and other investments that offer higher potential returns but come with greater risk,” he wrote.

Crypto

Which Cryptocurrency Under $0.50 Can Turn a $150 Investment Into $150,000 by 2025? Expert Top Picks Are… – Brave New Coin

Turning a small investment into a fortune is the dream of many crypto enthusiasts. With various coins priced under $0.50, the opportunity is tantalizing. This article dives into the top expert picks that have the potential to transform a modest $150 into a staggering $150,000 by 2025. Discover which cryptocurrencies are poised for explosive growth.

CYBRO Presale Climbs Past $2.5 Million: A One-in-a-Million DeFi Investment Opportunity

CYBRO is capturing the attention of crypto whales as its exclusive token presale quickly surges above $2.5 million. This cutting-edge DeFi platform offers investors unparalleled opportunities to maximize their earnings in any market condition.

Experts predict a potential ROI of 1200%, with CYBRO tokens available at a presale price of just $0.03 each. This rare, technologically advanced project has already attracted prominent crypto whales and influencers, indicating strong confidence and interest.

Holders of CYBRO tokens will enjoy lucrative staking rewards, exclusive airdrops, cashback on purchases, reduced trading and lending fees, and a robust insurance program within the platform.

With only 21% of the total tokens available for this presale and approximately 80 million already sold, this is a golden opportunity for savvy investors to secure a stake in a project that’s truly one in a million.

>>>Join CYBRO and aim for future returns up to 1200%

LUNC: Terra Classic’s Role in the Global Payments Ecosystem

Terra Classic, known as LUNC, is a blockchain protocol utilizing stablecoins for price-stable global payments. Combining stability and adoption of fiat with Bitcoin’s resilience, Terra aims for efficient transactions. Its mainnet launched in 2019, and expanded with stablecoins linked to several currencies. In 2022, Terra Classic emerged after a rebranding, with its native token LUNA renamed LUNA Classic. While the new Terra chain focuses elsewhere, LUNC draws parallels to historic blockchain splits. With its unique approach to stablecoins, LUNC offers potential for those seeking an innovative payments system. The design seeks to balance stability and speed, reflecting lessons learned from past crypto market challenges.

Stellar (XLM): A Bridge for Global Fund Transfers

Stellar (XLM) offers a platform for fast, affordable fund transfers by connecting diverse financial systems. It uses blockchain technology to support currencies from around the world, including cryptocurrencies like Bitcoin. Stellar Lumens, its own currency, helps facilitate these transactions. The network aims to improve existing financial setups, not replace them. Both individuals and businesses can benefit, using Stellar for global money transfers or building blockchain apps. The Stellar Development Foundation encourages using the network for things like NFTs and smart contracts. Over the years, Stellar has built meaningful partnerships and processed a massive number of transactions, creating a promising stage for its future growth.

Kaspa: The Future of Fast and Secure Transactions

Kaspa is a proof-of-work cryptocurrency using the GHOSTDAG protocol. Unlike typical blockchains, GHOSTDAG lets blocks coexist rather than reject them. It organizes them while keeping them all. Kaspa uses a blockDAG structure for high-speed and secure transactions. It can currently process one block per second, with goals of increasing that significantly. This allows nearly instant confirmations. Kaspa includes features like Reachability, SPV proofs, and plans for subnetwork support. These enhance its scalability and could simplify layer 2 developments. This innovative approach positions Kaspa as a promising player in the crypto landscape. With this setup, Kaspa offers quick and secure transactions, making it an exciting option for users.

VeChain’s Blockchain Powers Real-World Solutions in Enterprise

VeChain is a blockchain platform that is transforming how industries track goods. Known for its supply chain solutions, it lets companies monitor products like food, fashion, and cars. With its native token, VET, ranking high in market cap, it’s clear that VeChain has significant use and acceptance. By assigning IDs and sensors to products, it helps verify authenticity and manage recalls, proving vital for luxury and automotive industries. Founded by Sunny Lu, it moved from Ethereum to its own blockchain, VeChainThor. This switch introduced a dual-token system and a proof of authority for better transaction validation. Major partnerships demonstrate its practical applications, making VeChain a key player in blockchain solutions.

Dogecoin’s Rise: From Meme to Major Cryptocurrency Player

Dogecoin started as a light-hearted alternative in the crypto world. Its Shiba Inu logo became a popular symbol online. Unlike Bitcoin, Dogecoin has no supply limit, which means coins are always being produced. It gained attention when its value soared, influenced by Elon Musk and social media buzz. Dogecoin’s playful origins didn’t stop it from becoming one of the top cryptocurrencies by market cap. Its journey shows how community support and online trends can shape financial markets. With many fans worldwide, Dogecoin remains an interesting part of the digital currency landscape.

Conclusion

LUNC, XLM, KAS, and VET have less potential for short-term gains. In contrast, CYBRO offers a unique advantage. As a DeFi platform, it uses AI-powered yield aggregation on the Blast blockchain. This provides lucrative staking rewards, exclusive airdrops, and cashback on purchases. It ensures seamless deposits and withdrawals, focusing on transparency and compliance. CYBRO has attracted strong interest from crypto whales and influencers. Its advanced technology and superior user experience make it a promising project to watch.

Site: https://cybro.io

Twitter: https://twitter.com/Cybro_io

Discord: https://discord.gg/xFMGDQPhrB

Telegram: https://t.me/cybro_io

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article.

Crypto

PayPal Introduces Cryptocurrency Trading for US Merchants – Brave New Coin

Global payments giant PayPal will allow U.S. business account holders to buy, sell, and hold cryptocurrencies directly from their accounts.

Global payments giant PayPal has unveiled new features allowing U.S. business account holders to buy, sell, and hold cryptocurrencies directly from their accounts.

The move comes as more business clients seek access to crypto services available to consumers. PayPal also intends to expand its cryptocurrency features into regular business operations. According to the statement, this feature will be unavailable in New York State.

PayPal’s peer-to-peer payments app Venmo initially allowed clients to manage cryptocurrency in 2020. Since then, they have “continuously made significant steps to increase cryptocurrency utilization,” the statement read.

“Business owners have increasingly expressed a desire for the same cryptocurrency capabilities available to consumers. We’re excited to meet that demand by delivering this new offering, empowering them to engage with digital currencies effortlessly,” said Jose Fernandez da Ponte, senior VP of blockchain, cryptocurrency, and digital currency at PayPal.

According to PayPal’s statement, the new features of crypto services for business accounts aim to boost crypto’s real-world utility. The company’s latest move is a response to business owners who have been asking for access to crypto services since the platform launched its consumer-level digital currency services.

“Since we launched the ability for PayPal and Venmo consumers to buy, sell, and hold cryptocurrency in their wallets, we have learned a lot about how they want to use their cryptocurrency,” Fernandez da Ponte added.

PayPal stock has climbed roughly 26% this year, suggesting positive sentiment from investors.

Businesses can Now Transfer Cryptocurrency On-Chain to External Wallets

In addition to the new buying and selling ability, U.S. merchants can now transfer cryptocurrencies to third-party wallets. This new functionality extends the flexibility of digital currency transactions for businesses.

“PayPal business account holders can now send and receive supported cryptocurrency tokens to and from external blockchain addresses,” the company mentioned in its statement.

Last month, Crypto.com teamed up with PayPal to allow US users to make purchases through cryptocurrencies. This alliance expands on earlier joint ventures between the two businesses, which included allowing PayPal to recharge Crypto.com Visa Card. Besides Crypto.com, PayPal’s stablecoin is available within selected exchanges including Coinbase, Bitstamp, and Kraken.

PayPal Cuts Fees by Expanding PYUSD to Solana

In 2023, PayPal launched its own US dollar-denominated stablecoin (PYUSD), in August 2023. PYUSD was issued by a US-regulated entity named Paxos Trust Company. Initially, PYUSD was launched as an ERC-20 token through the Ethereum blockchain.

One limitation of Ethereum-based stablecoins is their high transaction fees. PayPal expanded PYUSD to the Solana network in May 2024 to minimize the cost. This move led to a significant fee reduction (sometimes over 90%). These lower transaction rates on Solana made PYUSD more attractive for regular purchases like coffee or groceries, which boosted the demand for PayPal to introduce crypto services to businesses.

“The Solana network’s speed and scalability make it the ideal blockchain for new payment solutions that are accessible, cost-effective, and instantaneous,” said Sheraz Shere, General Manager of Payments at the Solana Foundation. “Continued adoption from industry participants like PayPal helps realize the next generation of fintech innovation.”

According to BraveNewCoin data, PYUSD’s market capitalization has expanded dramatically since its introduction over a year ago, rising from approximately $45 million in September 2023 to around $700 million at the time of writing.

-

Politics1 week ago

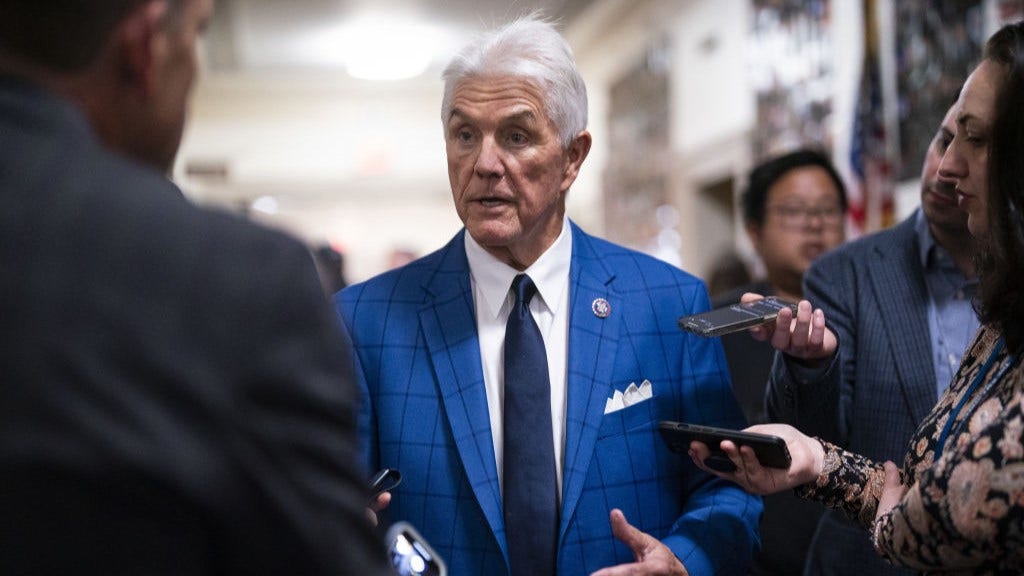

Politics1 week agoNew House Freedom Caucus chair reveals GOP rebel group's next 'big fight'

-

News1 week ago

News1 week agoToplines: September 2024 Inquirer/Times/Siena Poll of Pennsylvania Registered Voters

-

Business1 week ago

Business1 week agoVideo: Federal Reserve Cuts Interest Rates for the First Time in Four Years

-

Business1 week ago

Business1 week agoCheaper Mortgages and Car Loans: Lower Rates Are on the Horizon

-

Politics1 week ago

Politics1 week agoDem lawmakers push bill to restore funding to UN agency with alleged ties to Hamas: 'So necessary'

-

World1 week ago

World1 week agoWATCH: Hungary braces for what could be the worst floods in a decade

-

World1 week ago

World1 week agoWhat’s South Africa’s new school language law and why is it controversial?

-

Politics1 week ago

Politics1 week agoHouse committee to demand 'stonewalled' memo detailing Biden agency's 'curious' voter registration work