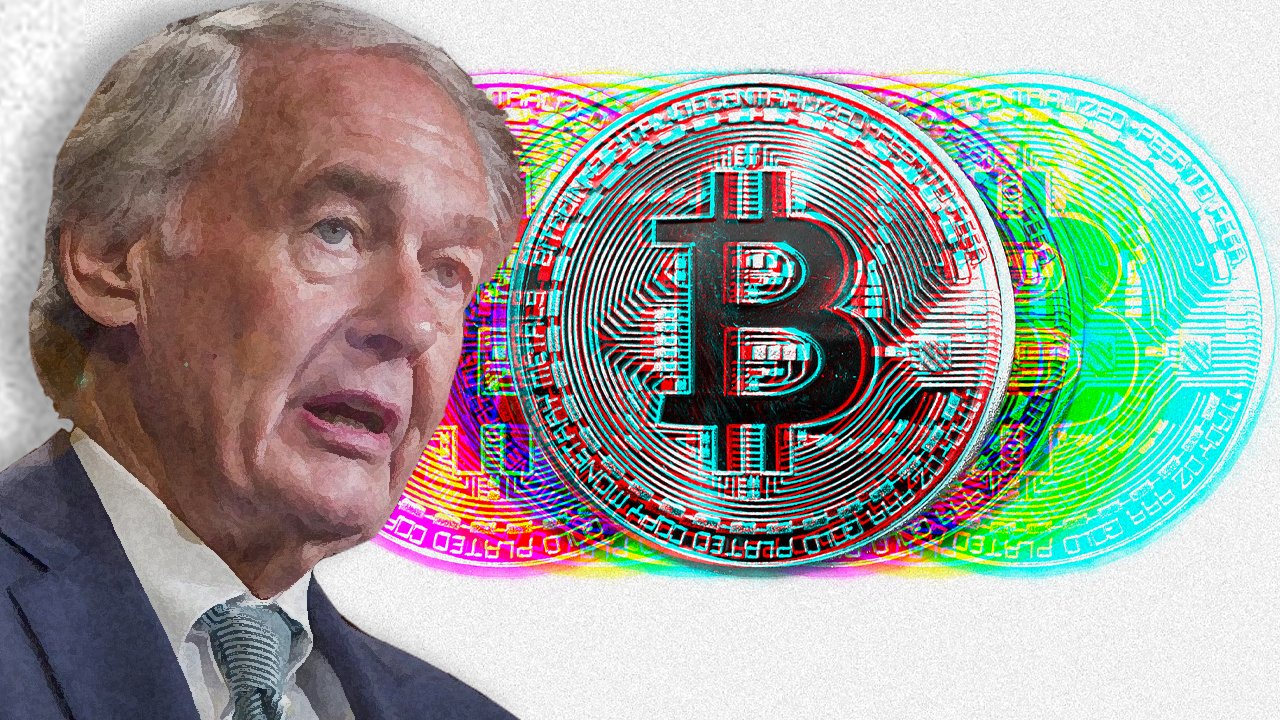

On Dec. 8, 2022, three Democratic politicians from Massachusetts, Oregon, and California revealed laws aimed toward combatting “energy-intensive” cryptocurrency mining operations. The invoice launched by senator Ed Markey (D-MA) alleges that crypto mining “strains the grid” and the business “undermines U.S. local weather objectives.”

3 U.S. Bureaucrats Consider Crypto Miners Have to Report Carbon Emissions and Environmental Assessments

Senators Ed Markey (D-MA), Jeff Merkley (D-ORE), and Jared Huffman (D-CA) have launched a invoice that will require “an interagency examine on the environmental and power impacts of crypto asset mining.” Markey’s press launch in regards to the “Crypto Asset Environmental Transparency Act” particulars that the U.S. Environmental Safety Company (EPA) would lead the examine.

Moreover, the EPA would assess crypto mining exercise within the U.S. and operations could be required to report greenhouse gasoline (GHG) emissions. Crypto mining corporations required to report GHG emissions could be “operations that eat greater than 5 megawatts of energy,” the press launch particulars.

“Huge-money [crypto mining] corporations are undermining a long time of progress in our combat in opposition to local weather change by placing earnings over the promise of our clear power future – jeopardizing the reliability and security of our grid within the course of and making it all of the extra probably for utilities to lift power costs on working households,” senator Markey mentioned on Thursday.

Consultant Jared Huffman mentioned the invoice would lastly pull “the curtain again on this business.” Huffman added:

The time for transparency, oversight, and accountability is now.

The bureaucrats’ invoice goals to fight so-called local weather change, a story that U.S. politicians and leaders worldwide have been pushing for years. Markey’s opinions comply with plenty of research and analysis stories that point out operations like bitcoin (BTC) mining are literally advantageous, not just for relieving the grids leveraged but additionally eradicating carbon emissions.

For example, the environmental, social, and governance (ESG) analyst, Daniel Batten, printed a report that claims bitcoin mining may get rid of the world’s carbon emissions by 5.32%. On Nov. 29, 2022, the Electrical Reliability Council of Texas (ERCOT) printed a report that exhibits bitcoin mining is useful to the Texas grid. ERCOT’s examine signifies that bitcoin mining operations in Texas may curtail 1.7 gigawatts (GW) of power in the course of the Texas winter.

Bitcoin mining can be recognized to mitigate flare gasoline (the discharge of uncooked gasoline into the environment) and landfill gasoline. Within the press launch printed on Thursday, nonetheless, U.S. senator Merkley argued that “Crypto asset mining consumes huge quantities of electrical energy” and burdened “most of which is generated by burning fossil fuels.” Nonetheless, varied research over time point out {that a} majority of bitcoin mining operations are pushed by renewable power sources.

The bureaucrats’ act is endorsed by the Sierra Membership, Earthjustice, Environmental Working Group, and Seneca Lake Guardian. “Digital belongings that depend on proof-of-work are wasteful by design,” Scott Faber, the senior vice chairman for presidency affairs on the Environmental Working Group mentioned in a press release. “Sturdy federal laws should handle” the state of affairs, Earthjustice’s clear power legal professional Mandy DeRoche added.

Tags on this story

Bitcoin, Bitcoin Mining Operations, Bureaucrats, california, Carbon Emissions, local weather change, local weather disaster, Democratic politicians, Earthjustice, Ed Markey (D-MA), Vitality, Environmental Working Group, EPA, Flare Gasoline, GHG emissions, greenhouse gasoline, grid, Jared Huffman (D-CA), Jeff Merkley (D-ORE), Laws, Massachusetts, Mining Operations, oregon, renewables, Seneca Lake Guardian, Sierra Membership

What do you concentrate on the U.S. bureaucrats’ invoice that goals to control crypto mining and power operations to report greenhouse gasoline emissions? Tell us what you concentrate on this topic within the feedback part under.

Jamie Redman

Jamie Redman is the Information Lead at Bitcoin.com Information and a monetary tech journalist residing in Florida. Redman has been an lively member of the cryptocurrency neighborhood since 2011. He has a ardour for Bitcoin, open-source code, and decentralized functions. Since September 2015, Redman has written greater than 6,000 articles for Bitcoin.com Information in regards to the disruptive protocols rising at present.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any injury or loss brought about or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25382021/V4_Pro_Beta_PressKit_LaunchImage.jpg)