When Russia invaded Ukraine in February last year, donations poured in to support Ukraine’s 43-million strong population; many were displaced by the violence, forced to fight in the war, or fled to other nations.

Several donations to Ukraine were made via cryptocurrencies, with the active encouragement of the country’s government. Mykhailo Fedorov, Vice Prime Minister of Ukraine for Innovations, Development of Education, Science & Technologies, even shared digital addresses to send donations via various cryptocurrencies.

In February 2023, over a year after the invasion, crypto analytics platform Chainalysis estimated that Ukraine had received roughly $70 million in crypto donations via Ukrainian government addresses. The most popular assets for such donations were Bitcoin, the largest crypto by market capitalisation, and Ether. Another popular cryptocurrency was the USDT stablecoin, supposedly a less volatile digital asset that reflected the US dollar’s value.

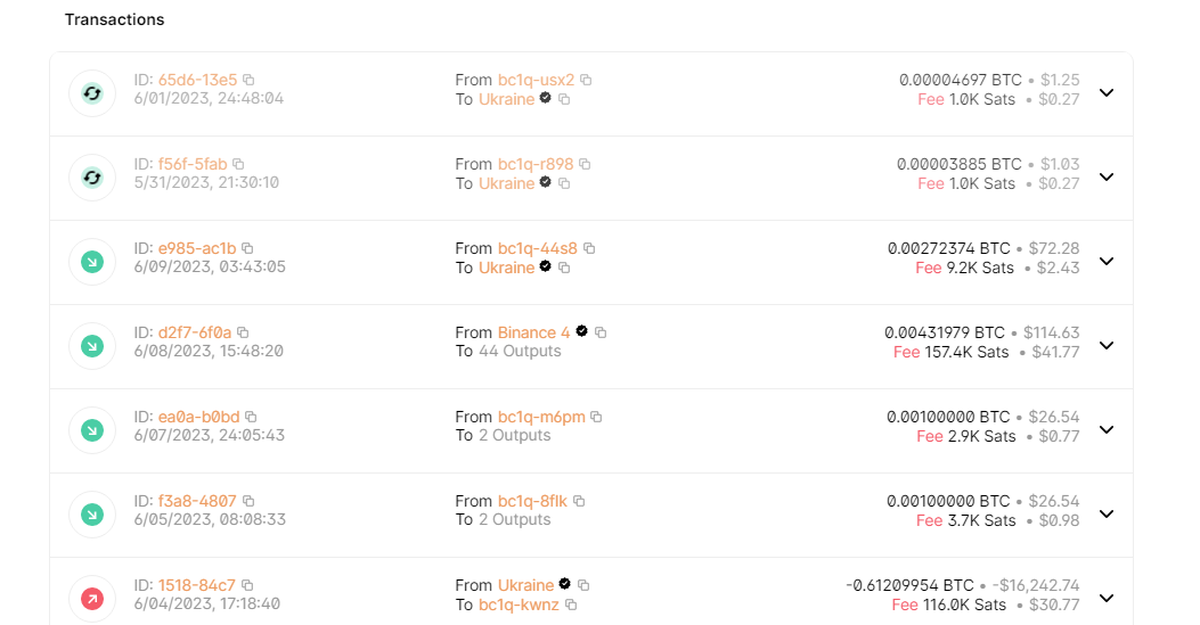

Screenshot of recorded transactions for the BTC address shared on Fedorov’s Twitter account

| Photo Credit:

Blockchain.com

In Central Asia, according to some reports, crypto transfers have helped feed families in war-ravaged Afghanistan when U.S. sanctions made it almost impossible to send money into the Taliban-ruled country. Charities active in the area are also considering crypto to ensure their donations are not misused by the Taliban.

Screenshot of a donation page for the ‘Code To Inspire’ nonprofit

| Photo Credit:

Code to Inspire

Faster settlement times, lower transaction fees, and absence of intermediaries make crypto an important option in money transactions. Crypto donations are also recorded on distributed ledgers that provide transparency to donors on incoming and outgoing funds. Such factors provide an impetus for charities worldwide to both accept and distribute cryptocurrencies.

Screenshot of recorded transactions for the BTC address shared on Fedorov’s Twitter account

| Photo Credit:

Blockchain.com

Crypto charity versus volatility

Crypto has made inroads into the United Nations. The UNICEF CryptoFund, launched in 2019, consists of a “pooled fund of bitcoin and ether” which it donates and invests in early-stage startups.

(For top technology news of the day, subscribe to our tech newsletter Today’s Cache)

In response to The Hindu’s emailed query, Sanna Bedi, Innovation Specialist (Crypto Strategy), UNICEF Office of Innovation, said that making investments in crypto provided an “unprecedented level of transparency on how funds are used.”

“It also allows UNICEF to benefit from the efficiency that distributed ledger technology provides, allowing the transfer of assets around the world in less than 10 mins, for typically less than 0.1% transfer fees,” Bedi said.

However, regulators worldwide warn users about investing in crypto assets, citing extreme volatility. Even trusted projects with market caps of billions of dollars can lose almost all their value within hours. In 2022, the TerraUSD and Luna cryptocurrencies failed and investors lost their money.

Screenshot of a candlestick graph showing the drastic fall in LUNA’s price in 2022

| Photo Credit:

TradingView

Ordinary crypto prices can also fluctuate by hundreds or thousands of dollars in a few minutes, reacting to both technical factors and world events such as war, economic panic, or even celebrity tweets.

Bedi told The Hindu that the CryptoFund did not convert its crypto to cash, to reduce the impact of market volatility.

“The Fund also maintains that all agreements related to crypto investment are made in either ETH or BTC, which enables startups to use their investment as cryptocurrency (i.e., they do not convert it upon receipt),” said Bedi, adding that its contracts were designed to be adjusted in case a large change in value affected the company receiving a crypto investment.

Save the Children USA said that crypto donations helped raise funds urgently to support its humanitarian responses, and reach out to new donors. The foundation’s Indian unit does not accept crypto donations.

“The majority of our crypto donors have been first time donors to Save the Children USA, so this emerging donation type has enabled us to reach a new and growing group of supporters,” said a spokesperson for the company, adding that the crypto community was “incredibly philanthropic.”

Save the Children USA said that it avoided price volatility by immediately selling and converting donated crypto to US dollars to make them operational – the very opposite of the UNICEF and its CryptoFund.

A new paradigm for donations?

Crypto transactions in wartime are not technological or humanitarian achievements, says Pete Howson, Assistant Professor in International Development at Northumbria University, and author of the upcoming book Let Them Eat Crypto.

“When people are desperate, they will try anything. They will trade illicit things to survive. Some will even sell their own body parts. That doesn’t mean human organs work as money. Nor does Bitcoin. Neither trade should be celebrated,” Howson told The Hindu by email.

“Using cryptocurrencies for something other than speculation – just like cocaine, kidneys, and blood diamonds – is nothing more than a measure of duress and/or desperation,” he added.

Howson pointed out how the aftermath of disasters such as the 2023 Turkey-Syria earthquake saw unverified campaigns sharing crypto wallet QR codes to scoop up donations.

Even the transparency offered by blockchain technology does not guarantee honest accounting. In April, news outlet Kyiv Post reported allegations that the celebrity-endorsed UkraineDAO organisation – which was raising crypto donations and claiming to have the support of the Ukrainian Ministry of Digital Transformation – was not sending all donations to its recipients. It was instead paying its leader a salary of $5,000 a month, alleged one source.

The full value of funds that did not reach recipients as promised could be roughly $700,000, the Kyiv Post noted. Further, Oleksandr Bornyakov, Ukraine’s Deputy Minister for Digital Transformation, denied endorsing the campaign.

There are also crypto projects based on donating crypto, but these raise ethical doubts about the kind of “help” they provide – and what they take in return.

Quick facts about the Worldcoin cryptocurrency project

| Photo Credit:

Information sourced from worldcoin.org and @Snowden on Twitter; Graphic compiled with Canva

Crypto and Indians

Cryptocurrency is not just a debate for North American and European governments. In Chainalysis’ 2022 Global Crypto Adoption Index list, which measures where people are investing in crypto, India ranks fourth, just one place below Ukraine and one place above the U.S.

Though the Indian government taxes crypto profits, it has not officially recognised the asset. Regardless, India’s crypto traders and investors are rising in number.

Howson called for a coordinated crackdown by governments as well as internet blocks on unregulated crypto trading sites.

“Crypto is ruining people’s lives across India,” he said. “We hear stories of amateur crypto traders in India killing themselves and their families. When charities get involved in this industry, they rub blood on their hands.”

Jury is still out on crypto donations

While several crypto advocates and self-styled analysts predicted that Bitcoin would reach all-time highs in 2022 and 2023, this was far from reality.

Bitcoin’s value has crashed since January 1, 2022 when it was trading at around $46,000. The largest cryptocurrency as on June 9 was trading at under $27,000.

Despite the volatility of crypto, a widespread distrust in cash-based donations and an increased desire for transparency prompt some givers to choose Bitcoin over dollars. More charities are responding to this shift in attitudes.

“We cannot solve tomorrow’s problems with yesterday’s solutions,” said Ettore Rossetti, Head of Web3 and Digital Innovation at Save the Children USA. “We need to continue to innovate, adapt and evolve in order to solve the problems children face in the future.”

On the other hand, crypto—like dollars and rupees—does not guarantee that all donations will reach their intended recipients.

“If people need transparency when donating to good causes, the best thing they can do is give real money to real charities, not fake money to fake charities via a network of shadow banks,” said Howson.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25751312/2024_CH_Pacifica_Gas_Gallery_Img3_Desktop1.jpg.image.1440.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25739950/247386_Elon_Musk_Open_AI_CVirginia.jpg)

✓ Share: