Kevin Helms

A pupil of Austrian Economics, Kevin discovered Bitcoin in 2011 and has been an evangelist ever since. His pursuits lie in Bitcoin safety, open-source programs, community results and the intersection between economics and cryptography.

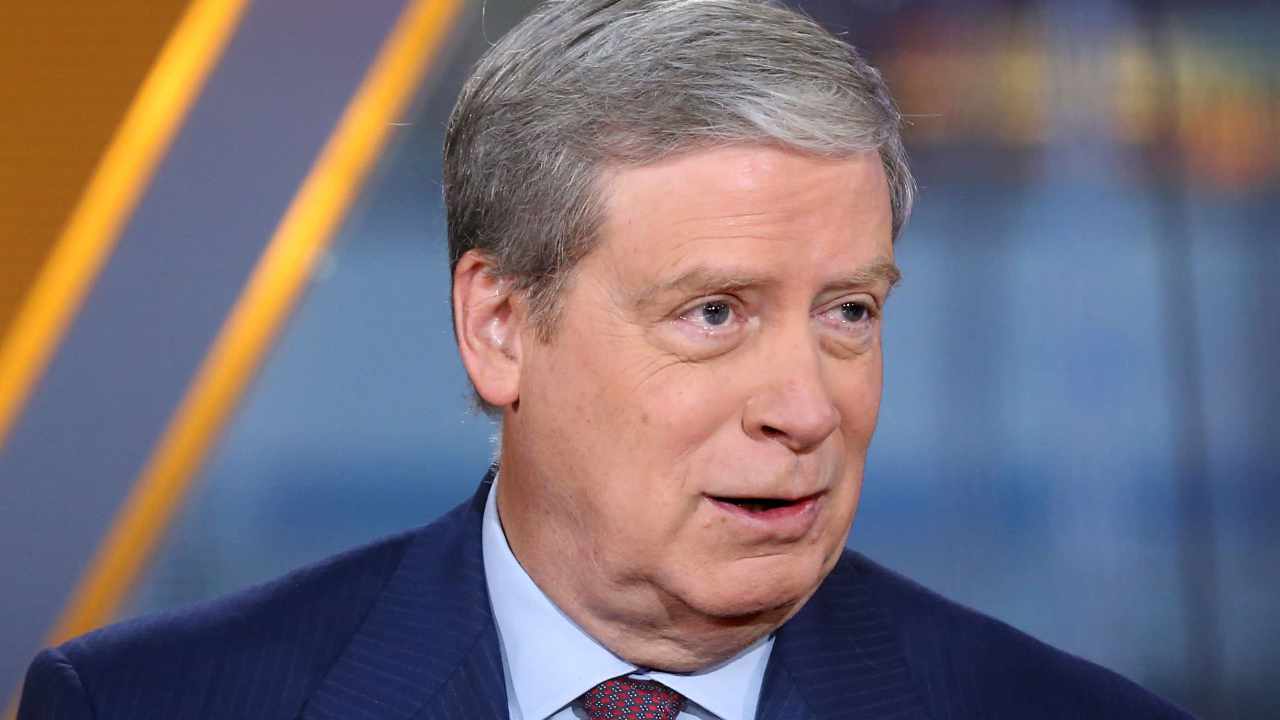

Famend billionaire hedge fund supervisor Stanley Druckenmiller says he may see cryptocurrency “having an enormous function in a Renaissance as a result of individuals simply aren’t going to belief the central banks.” He added that he will likely be “surprised” if the U.S. isn’t in a recession subsequent 12 months.

Billionaire investor Stanley Druckenmiller mentioned the U.S. economic system and cryptocurrency in an interview on the CNBC Delivering Alpha convention Wednesday. Druckenmiller is the chairman and CEO of Duquesne Household Workplace LLC. He was beforehand a managing director at Soros Fund Administration the place he had total accountability for funds with a peak asset worth of $22 billion. In keeping with Forbes’ listing of billionaires, his private web price is at the moment $6.4 billion.

Referencing the information of the Financial institution of England shopping for 65 billion kilos of U.Okay. bonds, he mentioned “if issues get actually unhealthy” and different central banks take related motion within the subsequent two or three years:

I may see cryptocurrency having an enormous function in a Renaissance as a result of individuals simply aren’t going to belief the central banks.

Nonetheless, he revealed that he doesn’t personal any bitcoin or different cryptocurrencies, including, “it’s powerful for me to personal something like that with central banks tightening.”

Specializing in the U.S. economic system, Druckenmiller careworn that the Federal Reserve was “taking unbelievable dangers.” He emphasised, “We’re taking this large gamble the place you threaten 40 years of credibility with inflation, and also you’re blowing up the wildest raging asset bubble I’ve ever seen,” asserting:

The Fed was flawed. They made an enormous mistake.

“For those who bear in mind, the Fed did $2 trillion in QE after vaccine affirmation,” the billionaire defined. “On the identical time, their accomplice in crime, the administration, was doing extra fiscal stimulus — once more, post-vaccine, after it was clear emergency measures weren’t wanted — than we did in your complete nice monetary disaster.”

Druckenmiller continued: “For those who take a look at what the Fed did, the novel gamble they took to get inflation up 30 foundation factors from 1.7 to 2, it’s, to me, type of a risk-reward guess … They usually misplaced.”

He elaborated: “And who actually misplaced? Poor individuals in america, ravaged by inflation, the center class, and my guess is the U.S. economic system for years to return due to the extent of the asset bubble in time and period and breadth it went on.”

Relating to whether or not there will likely be a recession within the U.S., Druckenmiller shared:

Let me simply say this. I will likely be surprised if we don’t have a recession in ’23. Don’t know the timing, however actually by the top of ’23.

In a subsequent interview with Bloomberg Wednesday, the Duquesne Household Workplace CEO reiterated that Federal Reserve policymakers “have put themselves and the nation, and most significantly the individuals of the nation, in a horrible place.” He warned that “Inflation is a killer,” noting that “To maximise employment over the long term, it’s good to have secure costs.”

What do you consider the feedback by billionaire Stan Druckenmiller? Tell us within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any injury or loss brought on or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.

BlackRock‘s iShares Bitcoin Trust IBIT has seen its record-breaking streak of inflows come to an end on Wednesday.

What Happened: According to data from SoSoValue, IBIT recorded no net inflows for the day, snapping a 71-day stretch of continuous investment.

On Wednesday, spot Bitcoin ETF flows saw net outflows totaling $121 million, signaling a turbulent day for cryptocurrency investments.

Notably, Grayscale’s Bitcoin Trust ETF (GBTC) registered the most substantial single-day outflow, withdrawing $130 million.

Contrasting this, Fidelity Wise’s Origin Bitcoin Fund FBTC emerged as the frontrunner for inflows, attracting $5.61 million in a single day, followed closely by the collaborative ETF from Ark Invest and 21Shares

ARKB, which saw an influx of $4.17 million.

www.benzinga.com/events/digital-assets

Also Read: Jack Dorsey Wants To Make Bitcoin Mining As Easy As Plugging In A Lamp: Here’s How

Hong Kong Steps Into The Crypto ETF Arena

The news of BlackRock’s pause coincides with a significant development in the Asian market.

HashKey Exchange announced the completion of the first-ever cryptocurrency subscription for Bitcoin and Ethereum spot ETFs offered by Hong Kong-based Bosera International and HashKey Capital.

This subscription model allows for redemption without immediate sale of the underlying assets, potentially offering cost and liquidity benefits to investors.

Hong Kong’s foray into cryptocurrency ETFs marks a potential turning point for the Asian market.

These ETFs are expected to begin trading on the Hong Kong Stock Exchange on April 30, providing investors in the region with a new avenue for cryptocurrency exposure.

What’s Next: The Benzinga Future of Digital Assets event, scheduled for Nov. 19, will convene industry leaders, analysts, and investors to discuss these critical developments.

This conference presents a unique opportunity to gain insights into the future of Bitcoin ETFs, cryptocurrency subscriptions, and the broader digital asset ecosystem.

Don’t miss out on this chance to stay ahead of the curve in this rapidly changing market.

Read Next: Why Is MOG Crypto Coin Going Up? Trader Sees ‘Billions’ As Price Target

Image: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Scammers are exploiting the rising popularity of Telegram and its associated cryptocurrency, Toncoin (TON), to execute a highly scalable scheme design to pilfer the digital tokens from unsuspecting users. Kaspersky researchers have discovered the operation, which has been active since November 2023, and warns that it is a growing threat.

Victims are being lured into the scheme via an invitation to join an “exclusive earning program” received from a contact in their list. The invitation leads them to an unofficial Telegram bot, falsely touted as a cryptocurrency storage solution. The victims are then instructed to link it to a legitimate wallet and to buy Toncoins through official channels such as the official Telegram bot or through cryptocurrency exchanges.

After duping victims into purchasing the coins, scammers push them to buy so-called ‘boosters’ using a separate bot, stating that this is the step needed to commence earning. The ‘boosters’, likened to those seen in online games, are misleadingly marketed as tools that allow users to capitalise on their coins further. “This scheme resembles boosters in online games – by purchasing one, the user gains additional advantages,” explains Olga Svistunova, Senior Web Content Analyst at Kaspersky. Once bought these ‘boosters’ cost victims their cryptocurrency, and the money lost is irreversible.

Following the purchase of the scam ‘boosters’, users are manipulated into propagating the scheme. They are encouraged to create a private Telegram group with their friends and acquaintances, share a specially generated referral link and a video with instructions on earnings. The scammers claim that at least five people should join the private group via the referral link before a victim can start earning. They are also told that they will receive payment for each friend invited and will make a commission from each of the fraudulent ‘boosters’ purchased by those they have referred.

Alluding to the potential scale of the scam, the Telegram Open Network (TON) was developed by the Durov brothers and is now backed by an independent community. Telegram itself has reached 900 million monthly users and ranks globally as the 6th most used and 6th most downloaded app. This expansive user base increases both the potential pool of victims and the likely impacts of the scheme.

Kaspersky experts have urged all users to exercise caution when encountering offers of quick riches, even if they are received from friends or acquaintances. Avoid transferring cryptocurrency to unknown or suspicious wallets, and consider comprehensive protection for your digital assets, such as Kaspersky Premium which alerts you to suspicious websites and guards your wallet against scammers, miners and other threats. Staying updated and informed about the latest fraudulent schemes is another effective protective measure.

Keonne Rodriguez and William Lonergan Hill have been charged by the U.S. Department of Justice for laundering more than $100 million from various criminal enterprises through Samourai, a cryptocurrency mixer service they ran for nearly a decade.

As detailed in a superseding indictment, criminals also used Samourai’s Whirlpool crypto mixer to process over $2 billion in illicit funds between 2015 and February 2024.

In addition to crypto mixing services, Samourai also offered a service called “Ricochet,” which allowed users to send cryptocurrency using additional and unnecessary intermediate transactions to thwart law enforcement and crypto exchange efforts to track funds sourced from criminal activity.

This money laundering activity allegedly earned the two founders around $4.5 million in fees for Whirlpool and Ricochet transactions.

“Since the start of the Whirlpool service in or about 2019, and of the Ricochet service in or about 2017, over 80,000 BTC (worth over $2 billion applying the BTC-USD conversion rates at the time of each transaction) has passed through these two services operated by Samourai,” the indictment alleges.

Samourai’s Wallet mobile application was also downloaded over 100,000 times, allowing users to store private keys for BTC addresses they controlled and exchange funds with other Samourai users in anonymous financial transactions.

Icelandic law enforcement has seized Samourai’s domains (samourai[.]io and samouraiwallet[.]com) and web servers, and the Google Play Store removed the Android mobile app after being served a seizure warrant.

Rodriguez was taken into custody this morning and will appear before a U.S. Magistrate Judge in the Western District of Pennsylvania in the following days.

Hill was also arrested this morning in Portugal on U.S. criminal charges, with the U.S. government planning to request his extradition to the United States so that he can stand trial.

They’re both charged with two counts of conspiracy: money laundering (20-year maximum sentence) and operating an unlicensed money-transmitting business (5-year maximum sentence).

“While offering Samourai as a ‘privacy’ service, the defendants knew that it was a haven for criminals to engage in large-scale money laundering and sanctions evasion,” the DOJ said.

“Samourai laundered over $100 million of crime proceeds originating from, among other criminal sources, illegal dark web markets, such as Silk Road and Hydra Market; various wire fraud and computer fraud schemes, including a web-server intrusion, a spearphishing scheme, and schemes to defraud multiple decentralized finance protocols; and other illegal

If not Ursula, then who? Seven in the wings for Commission top job

Film Review: Season of Terror (1969) by Koji Wakamatsu

Croatians vote in election pitting the PM against the country’s president

GOP senators demand full trial in Mayorkas impeachment

Trump trial: Jury selection to resume in New York City for 3rd day in former president's trial

'You are a criminal!' Heckler blasts von der Leyen's stance on Israel

The Take: How Iran’s attack on Israel unfolded

Movie Review: The American Society of Magical Negroes