Business

U.S. to Begin Formal Trade Talks With Taiwan

The Biden administration mentioned on Wednesday that it will start formal commerce negotiations with Taiwan this fall, after a number of weeks of rising tensions over the island democracy that China claims as its personal.

The announcement marks a step towards a pact that will deepen financial and technological ties between america and Taiwan, after preliminary talks had been introduced in June. However relations between america and China have markedly deteriorated since then, on the heels of visits by two delegations of U.S. lawmakers to Taiwan this month, together with by Speaker Nancy Pelosi.

The journeys angered the Chinese language authorities, which sees the island as an incontestable a part of its territory and has responded by ramping up navy drills and firing missiles into the waters round Taiwan. The USA, in flip, has accused China of utilizing the visits as a pretext to step up operations to intimidate Taiwan, and has vowed to keep up its personal navy operations within the area.

Talks for the pact, referred to as the U.S.-Taiwan Initiative on Twenty first-Century Commerce, will give attention to 11 commerce areas, the announcement from the Workplace of america Commerce Consultant mentioned, together with increasing commerce in agriculture and digital industries, elevating labor and environmental requirements, and enhancing commerce between small and medium-size companies.

The governments additionally mentioned they might fight market distortions attributable to state-owned enterprises, in addition to nonmarket insurance policies and practices — an obvious nod at China, the place such practices are frequent.

The U.S.-Taiwan commerce initiative can be negotiated by the American Institute in Taiwan, which is the unofficial U.S. embassy in Taipei, and the Taipei Financial and Cultural Consultant Workplace in america, which represents Taiwan in Washington within the absence of diplomatic recognition.

The Biden administration is finishing up a separate commerce negotiation with 13 Asian nations to type a pact referred to as the Indo-Pacific Financial Framework. Taiwan has expressed curiosity in becoming a member of these talks, however given its contested standing, it has not been invited to take part.

In a briefing on Wednesday, Daniel J. Kritenbrink, the assistant secretary of state for East Asian and Pacific affairs, defended what he referred to as “an formidable highway map for commerce negotiations” with Taiwan.

“We’ll proceed to meet our commitments underneath the Taiwan Relations Act,” he mentioned. “That features supporting Taiwan’s self-defense and sustaining our personal capability to withstand any resort to pressure or different types of coercion that will jeopardize Taiwan’s safety. And we’ll proceed, in keeping with our ‘one China’ coverage, to deepen our ties with Taiwan, together with by persevering with to advance our financial and commerce relations.”

Austin Ramzy contributed reporting.

Business

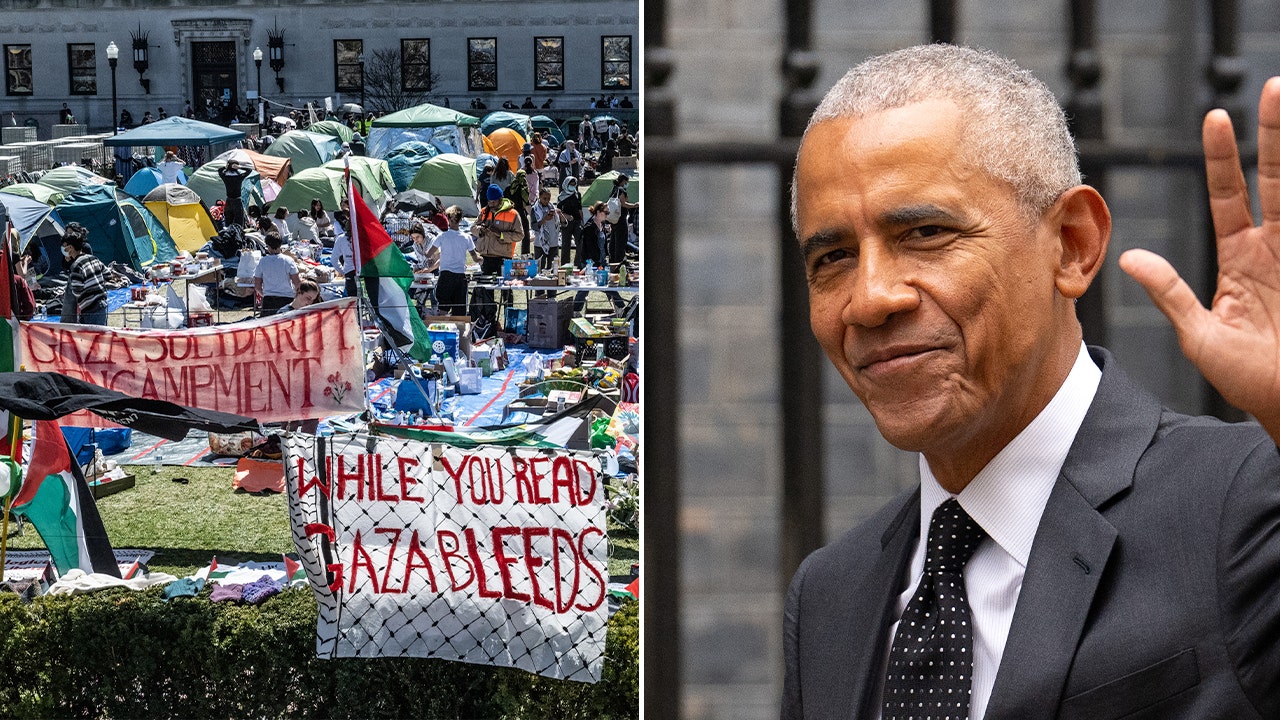

Google fired at least 20 additional workers after last week's Gaza protest, group says

Google fired additional workers this week, after it initially terminated 28 people who it said participated in recent protests against the company’s work in Israel.

The total number of employees terminated in the wake of the protests — which took place inside Google offices in New York and Sunnyvale, Calif. — has grown to more than 50 people, with more than 20 people ousted on Monday night, according to the No Tech for Apartheid Campaign, the advocacy group that organized the sit-ins.

Google, in a statement, confirmed that the company had cut additional workers as a result of its investigation into the protests, but did not say how many. The spokesperson said it took more time to identify some of the participants because their faces were concealed by masks and they weren’t wearing their employee badges.

“Our investigation into these events is now concluded, and we have terminated the employment of additional employees who were found to have been directly involved in disruptive activity,” the company said. “To reiterate, every single one of those whose employment was terminated was personally and definitively involved in disruptive activity inside our buildings. We carefully confirmed and reconfirmed this.”

The protest group has previously decried the firings and alleged that some of the terminated protesters didn’t participate directly in the events, a contention that Google vigorously disputed.

“Google is throwing a tantrum because the company’s executives are embarrassed about the strength workers showed at last Tuesday’s historic sit-ins, as well as their botched response to them,” No Tech for Apartheid Campaign said in a statement. “Now, the corporation is lashing out at any worker that was physically in the vicinity of the protest — including those who were not at all involved in the campaign.”

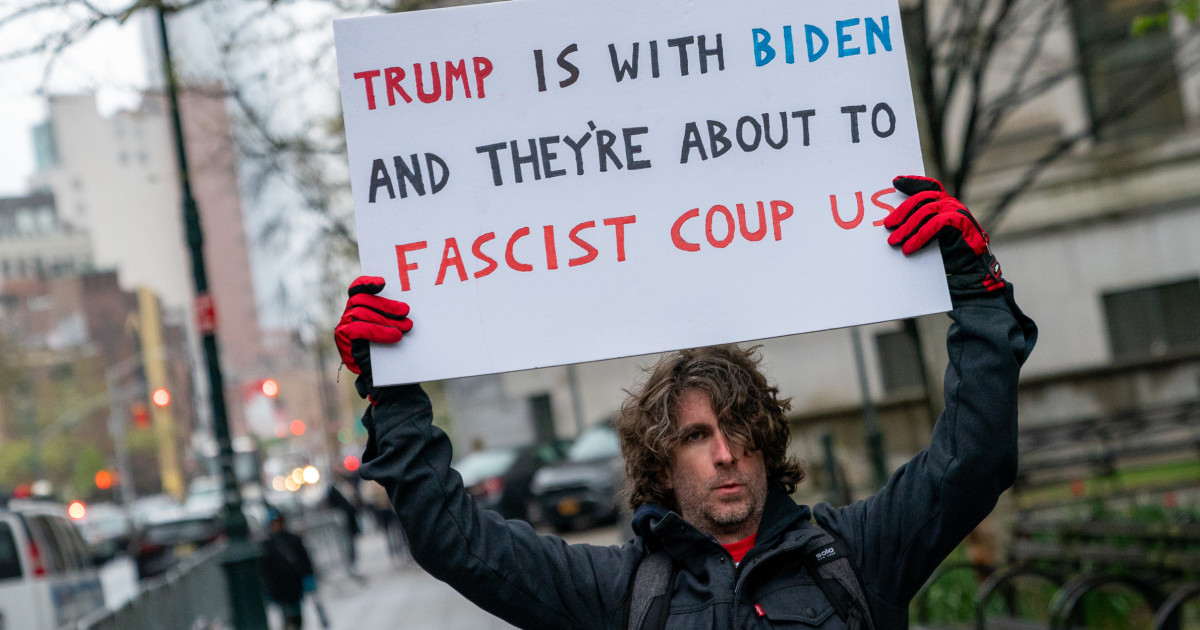

On April 16, the campaign held rallies outside of Google offices. Dozens of employees sat for hours in sit-ins the New York City and Sunnyvale locations, and nine people were arrested for trespassing.

The campaign is pushing for the company to drop its cloud computing contract with the Israeli government and military, called Project Nimbus. The group said that it will continue to demand that Google drop Project Nimbus, protect Palestinian, Arab and Muslim employees and reinstate the workers who were terminated.

After the protests and sit-ins, Google last week said it had fired the first 28 employees for violating company policy governing employee conduct and harassment.

In a blog post last week, Google Chief Executive Sundar Pichai wrote that while it is important to preserve the company’s culture of open discussion, Google must maintain a professional workplace.

“[O]ur policies and expectations are clear: this is a business, and not a place to act in a way that disrupts coworkers or makes them feel unsafe, to attempt to use the company as a personal platform, or to fight over disruptive issues or debate politics,” Pichai wrote.

Protests in the tech industry have escalated in the wake of Israel’s bombardment of the Gaza Strip, which began in response to the Oct. 7 attack on Israel by Hamas-led militants in which an estimated 1,200 people were killed and about 240 taken hostage.

More than 34,000 Palestinians in Gaza have been killed in Israel’s air and ground offensive, according to Gaza health officials.

“Google pays us enough to not think too much about what they are doing, but it wasn’t worth it,” said Hasan Ibraheem, one of the fired employees, during a Monday news conference. “I wanted to support my co-workers who have been harassed for standing up against this project.”

Google has said that its technology is used to support numerous governments around the world, including Israel’s, and that the Nimbus contract is for work running on its commercial cloud network, with the Israeli government ministries agreeing to comply with Google’s terms of service and acceptable use policy.

“This work is not directed at highly sensitive, classified, or military workloads relevant to weapons or intelligence services,” Google said in a statement.

But former Google employees at the news conference questioned how the company would enforce the terms of service and called for more transparency. They also disputed the characterization that they were disrupting the work of other employees.

Business

California in a jam after borrowing billions to pay unemployment benefits

California’s massive budget deficit, coupled with the state’s relatively high level of joblessness, has become a major barrier to reducing the billions of dollars of debt it has incurred to pay unemployment benefits.

The surge in unemployment brought on by the COVID-19 pandemic pushed the state’s unemployment insurance trust into insolvency. And over the last year California’s joblessness has been on the upswing again, reaching 5.3% in February, the highest among all states. The March job numbers come out Friday.

To keep the safety-net program operating at a time when the taxes paid by employers and earmarked for jobless benefits are insufficient, Sacramento has been borrowing billions of dollars from the federal government. The debt now stands at about $21 billion and growing, an increasing burden for state deficit fighters and for the businesses that pay into the jobless insurance program.

Payroll taxes paid by employers are rising not only to cover payouts to unemployed workers but also a state surcharge and a gradually increasing federal surtax to help pay off the principal on the debt. But the tax increases are not enough to deal with the huge loan the state has incurred, or at least not in any timely manner.

California already has paid more than $650 million in interest on the loan — and about $550 million more is due Sept. 30.

“Businesses are going to continue to see the slow boil eating into their margins,” said Robert Moutrie, senior policy advocate for the California Chamber of Commerce.

Higher taxes will hit small and midsize companies in sectors such as restaurants and tourism especially hard, he said.

“It just adds to the burden and the costs of operating here and makes companies look at operating elsewhere,” Moutrie said.

Although the pandemic is largely to blame for California’s huge unemployment insurance debt — and there’s been a lot of attention on dollars lost to fraud — analysts and workers’ rights groups point to another problem: Even during more-normal economic times, the state often doesn’t collect enough unemployment insurance taxes to cover jobless claims.

“The root problem really is that for decades policymakers haven’t been requiring businesses to pay enough into the [unemployment insurance] fund to support the benefits workers really need,” said Amy Traub, senior researcher and policy analyst at the National Employment Law Project.

“So there’s a structural deficit that underlies this crisis moment with this huge debt to the federal government.”

Data also show that jobless workers in California stay on unemployment significantly longer than the national average, which adds to the total payout amount. And California workers claim unemployment benefits in disproportionately high numbers.

The state accounts for about 20% of the nation’s jobless claims, far in excess of its 11% share of the labor force population. That partly reflects the state’s higher unemployment and accompanying increases in layoffs and jobless claims in the tech industry and other sectors, but also its comparatively easier eligibility rules and low re-employment rate.

Last year California’s jobless workers received on average $385 a week, replacing only about 28% of the average wage. Both figures are lower than the national averages, according to Department of Labor statistics. (The wage replacement rate is about 50% for minimum-wage workers in California.)

From surplus to deficit

But California also stands out as an outlier in the way it has managed, or mismanaged, the program.

When COVID struck in March 2020, U.S. unemployment jumped to 14.8% a month later and brought unprecedented jobless claims, forcing California and many other states to borrow from the federal government to keep paying benefits. Almost all the other states have since repaid those loans, some with pandemic relief money they also got from Washington.

Today only New York and California, plus the Virgin Islands, still owe money for unemployment insurance loans.

Analysts said California could have used some of the $43.5 billion the state received from the American Rescue Plan Act to pay down the debt. Instead, state officials spent the relief money for other purposes, including additional stimulus checks to residents.

“California had options and it chose the spending option instead of the responsible option,” said Matt Weidinger, a senior fellow at the American Enterprise Institute who has written widely on the unemployment insurance program. He said higher employer payroll taxes will ultimately spill over to employees in the form of less wages.

“California distributed relief during a time when people and businesses were struggling, everything from covering rent and utility bills to small business grants — helping those hardest hit by the pandemic while stimulating the economy,” said Alex Stack, a spokesman for Gov. Gavin Newsom’s office. “That’s on top of paying down $250 million of unemployment fund debts.”

State legislative analysts were careful not to criticize policy choices made during the extraordinarily uncertain times.

Some suggested, however, that officials may have felt the state had plenty of financial cushion coming out of the pandemic in 2021-22. Then, Sacramento was flush with cash, thanks to huge tax windfalls. And the interest rate on the federal unemployment insurance loan two years ago was at a historical low of 1.6%.

But the interest rate on the loan has since risen to 2.6% — and may yet rise further. What’s more, once huge surpluses are now a projected record budget deficit of more than $70 billion in 2024-25, according to a February update by California’s Legislative Analyst Office.

An economic downturn in the state, marked by a falloff in technology investment and rising overall unemployment, has resulted in unprecedented shortfalls in tax revenues.

Under such budget constraints, California officials had little choice but to pull back on plans to spend $1 billion to reduce the principal on the unemployment insurance loan.

What’s the solution?

California’s Employment Development Department, which oversees the state’s unemployment insurance program, has said that it would rely on increased federal taxes on employers to pay down the debt.

Currently California employers pay a federal unemployment insurance tax of 1.2% on the first $7,000 of wages per employee, but that will rise incrementally every year so long as California is in debt, to more than 3.5% after 10 years. And analysts estimate that it may take at least that long to pay off the debt.

Businesses also pay a state unemployment insurance tax, also on the first $7,000 of wages, based on their layoff history, plus a surcharge when there’s a shortfall in the jobless benefits fund.

Combining both state and federal portions, a new California employer, for example, would be looking at paying about $500 in unemployment insurance taxes per employee this year — almost double than during normal times.

“California’s apparent plan to rely on [federal tax] revenue to pay off the loan avoids addressing solvency in the state unemployment insurance law and places the burden of increased unemployment benefits during the pandemic on employers,” said Doug Holmes, former director of Ohio’s unemployment insurance program and currently president of the consulting firm UWC.

In California, business groups say it’s unfair for employers to shoulder the increasing burden when they weren’t responsible for the pandemic or the temporary lockdowns that were imposed on them, resulting in layoffs and higher unemployment claims. They argue that it will only add to the state’s already higher business costs that have pushed some California companies to relocate to Texas, Nevada and other states.

Traub, of the National Employment Law Project, said employers have to pay more to make the math work and ensure the unemployment trust system is sustainable over the long haul.

Sacramento collects unemployment insurance taxes on the first $7,000 of wages per employee per year. Traub noted that most other states have a significantly higher taxable wage limit — New York at $12,500; New Mexico at $31,700; and Washington state, the highest, at $68,500.

“Raising the taxable wage base has got to be part of the solution,” Traub said.

California legislators are now considering an increase, which many agree is needed. “That’s very reasonable,” said Michael Bernick, an employment attorney at Duane Morris in San Francisco.

Bernick was the EDD director in the early 2000s when, under Gov. Gray Davis, the state raised the maximum weekly unemployment benefits to $450 a week — but without increasing the taxes to cover the larger payments.

Writing in a report with Holmes, Bernick recommended a number of steps the EDD could take to shore up the state’s unemployment benefits program, including tightening eligibility standards and modernizing the agency’s computer and communications systems. But by far the main policy change that’s needed is to help jobless workers move into new jobs more rapidly.

In 2022, California workers stayed on unemployment aid for an average of 18.1 weeks, compared with 14.5 weeks nationally, according to a study by the Department of Labor’s former lead actuary, Robert Pavosevich.

In California that year, 47% of recipients took the full maximum 26 weeks of jobless benefits. Nationally, only 27% exhausted all benefit weeks available.

“Those are striking numbers and highlight just how much the system needs to be reshaped,” Bernick said. “How do we get people back to work quickly? It’s both good for businesses and the workers, but also for the unemployment fund.”

Business

Disney tech executive Aaron LaBerge leaves company after more than 20 years

Aaron LaBerge, chief technology officer of Disney Entertainment and ESPN, announced Monday that he is departing the Burbank-based media giant and will join casino and sports-betting company Penn Entertainment.

LaBerge will step into his new role as chief technology officer of Penn Entertainment in July, according to the Pennsylvania-based corporation, which offers integrated entertainment, sports content and casino gaming experiences. He has spent more than 20 years at Disney, where he specializes in technology and product for the company’s media divisions.

LaBerge will still be affiliated with ESPN because Penn Entertainment is behind ESPN Bet, the sports network’s gambling venture.

“I’m excited to join another talented team at PENN Interactive and lead our technology strategy,” LaBerge said in a statement.

“PENN Entertainment is at the forefront of the fast-changing gaming and sports media industry. I plan to use my experience from Disney and ESPN to help make ESPN BET an essential piece of the sports fan experience. Together, we’ll push the limits and redefine how fans interact with sports and gaming.”

In a memo to his team on Monday, LaBerge explained that he had decided to leave Disney for personal reasons related to his family .

“Disney is more than just a company to me; it’s been my home, my inspiration, and a part of the most rewarding chapters of my life, both personally and professionally,” LaBerge wrote in the memo.

“The true magic of Disney isn’t just in our stories or our technology but in each of you. Your passion, creativity, and brilliance have made my journey unforgettable.”

Disney chairmen Dana Walden, Alan Bergman and Jimmy Pitaro later informed staff that the search for LaBerge’s replacement is underway. Chris Lawson, executive vice president of content operations at Disney Entertainment and ESPN, will assume an interim leadership role in the months ahead of LaBerge’s exit.

-

News1 week ago

News1 week agoCross-Tabs: April 2024 Times/Siena Poll of Registered Voters Nationwide

-

Politics1 week ago

Politics1 week agoNine questions about the Trump trial, answered

-

World6 days ago

World6 days agoIf not Ursula, then who? Seven in the wings for Commission top job

-

World1 week ago

World1 week agoHungary won't rule out using veto during EU Council presidency

-

Movie Reviews7 days ago

Movie Reviews7 days agoFilm Review: Season of Terror (1969) by Koji Wakamatsu

-

World7 days ago

World7 days agoCroatians vote in election pitting the PM against the country’s president

-

World1 week ago

World1 week agoGroup of EU states should recognise Palestine together, Michel says

-

Politics6 days ago

Politics6 days agoTrump trial: Jury selection to resume in New York City for 3rd day in former president's trial