Business

John Visentin, Xerox C.E.O., Dies at 59

John Visentin, the chief government of Xerox who led the photocopying and know-how firm by way of a tumultuous pandemic at a time when demand for printed paperwork and ink waned, died on Tuesday. He was 59.

Mr. Visentin, who grew to become C.E.O. in Could 2018 and was additionally the vice chairman, died of “issues from an ongoing sickness,” the corporate mentioned in an announcement. A spokesman for Xerox didn’t share particulars about that sickness or say whether or not Mr. Visentin informed the corporate about it.

Steve Bandrowczak, the president and chief working officer at Xerox, will function its interim C.E.O., the corporate mentioned.

“John’s imaginative and prescient was clear, and the Xerox crew will proceed fulfilling it — not solely to ship on our commitments to our shareholders, clients and companions, but in addition to pursue John’s legacy,” Mr. Bandrowczak mentioned in an announcement.

Earlier than occupying the highest place at Xerox, Mr. Visentin was steeped on this planet of know-how and enterprise: He labored as an adviser to the chairman at Exela Applied sciences, an automation firm, and was an working companion for Introduction Worldwide, a personal fairness agency.

After becoming a member of Xerox, Mr. Visentin sought to broaden the corporate’s choices. For years, Xerox had been referred to as a hub for workplace know-how, particularly its xerographic copier, or Xerox machine — a ubiquitous, cumbersome product that commercialized the method of creating photographic copies onto paper.

Mr. Visentin turned extra consideration “to digital and I.T. providers, monetary providers and disruptive applied sciences,” James Nelson, the chairman of Xerox’s board of administrators, mentioned in an announcement.

Below Mr. Visentin’s helm, the corporate additionally tried to make inroads in 3-D printing.

His choice as C.E.O. in 2018 was preceded by Xerox’s calling off its merger take care of Fujifilm of Japan after reaching a settlement with a shareholder activist and one other main investor who sharply opposed the deal.

In November 2019, Xerox made a takeover provide to HP, a enterprise synonymous with printers, in an effort to mix the 2 firms and reduce prices.

The merger was supported by Mr. Visentin, who appeared to consider that the trade wanted some form of consolidation as a way to appease shareholders involved in regards to the accelerating erosion of the normal printing enterprise.

The deal deteriorated after HP discovered that the cash-and-stock provide from Xerox undervalued the corporate. Later that month, it formally turned down the takeover provide, dealing a blow to Mr. Visentin’s enterprise plans.

A graduate of Concordia College in Montreal, Mr. Visentin started his profession at IBM, in accordance with his LinkedIn profile. He labored there for greater than 20 years after which moved to HP. From 2013 to 2017, he was the chief government of Novitex Enterprise Options, his firm biography states.

Xerox described Mr. Visentin in its assertion as a frontrunner “who navigated the corporate by way of unprecedented occasions and challenges.”

He’s survived by his spouse and 5 daughters.

Jesus Jiménez contributed reporting.

Business

L.A. bookseller went to protect his kids from a fight. He was shot and paralyzed

Luis Hernandez was worried about his children shortly before he was shot in the back outside his business near MacArthur Park.

Now the 40-year-old may never walk again.

On April 6, Hernandez and his wife were closing up their store where they sell Christian literature, keychains, backpacks and other items when a car parked next to his vehicle.

Moments earlier, he’d placed his three children — ages 2, 4 and 8 — into his car in the 700 block of South Alvarado Street as his wife locked up the store. It was shortly before 9 p.m. As he walked back to his car, an argument broke out between a person on the sidewalk and a group of people in the car parked next to him.

He wanted to move his car and children away from where people were arguing. As he got in the car, someone fired a gun from inside the gray Toyota Camry parked next to him, according to the Los Angeles Police Department.

He was shot in the back, and the Camry drove away, police said.

Hernandez was rushed to Kaiser Permanente Los Angeles Medical Center, where doctors explained to his family that the bullet had struck his spine and he was paralyzed from the waist down, according to Nora Flores, Hernandez’s cousin.

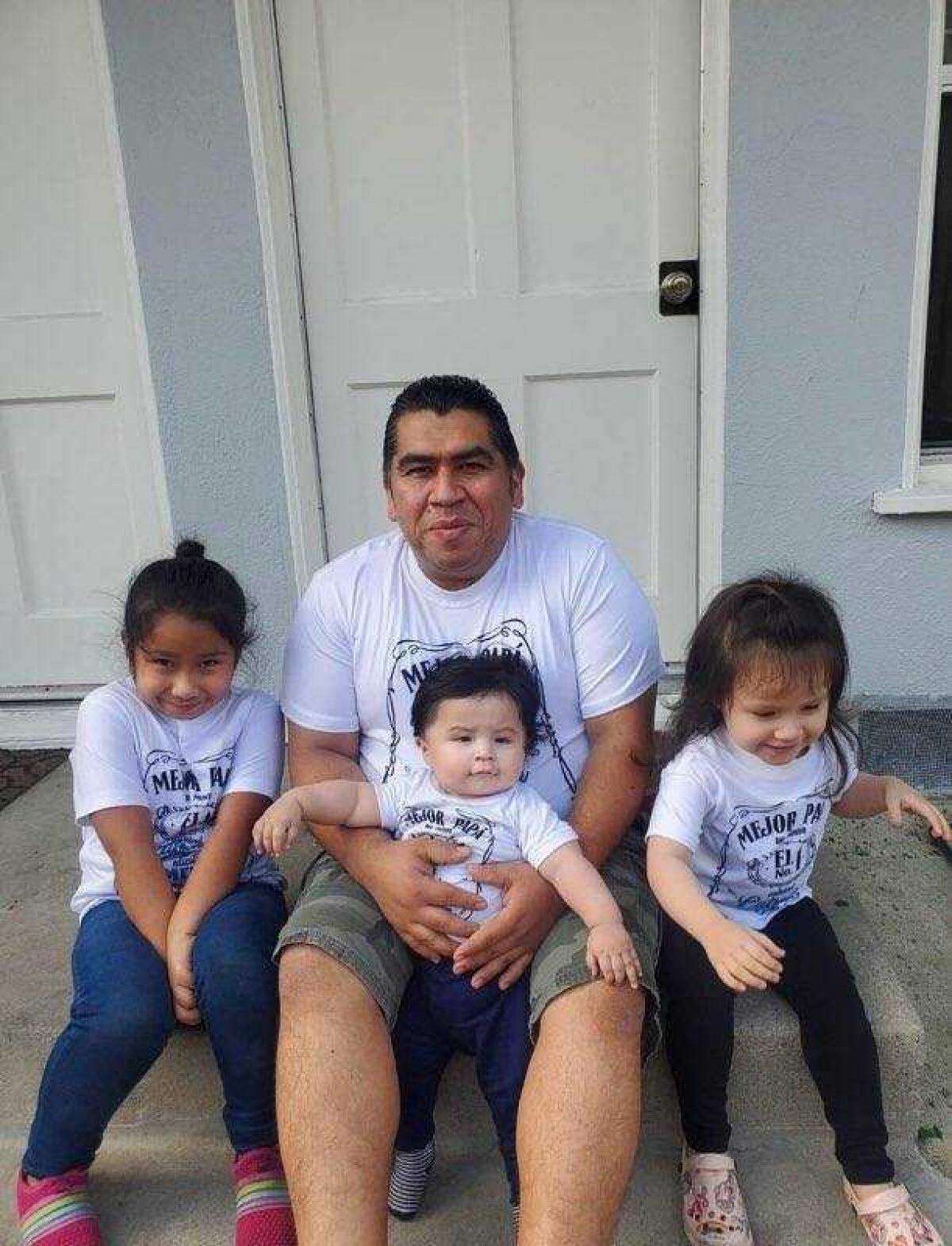

Luis Hernandez was shot in the back outside his business near MacArthur Park. Doctors say Hernandez is paralyzed from the waist down and no surgery will help.

(Courtesy of Nora Flores)

“They told us there was no other surgery they could do to reverse his condition,” Flores said. “We have faith that with physical therapy he can walk again. We’re trying to be very supportive.”

The people in the Camry are described as a man and woman and were last seen driving away, but there was no other information about the shooter or a motive, according to the LAPD.

“It just happened so fast,” said Hernandez’s wife, who does not want her name released because of safety concerns, as the suspects have not been identified.

Hernandez primarily works as a custodian and part-time at the store, which he opened about six years ago, according to Flores.

“He’s a very generous, kind person who is always willing to help. He’s a devoted father,” Flores said. “Whenever I see my cousin, I get happy, because his energy is always positive.”

Hernandez arrived in Los Angeles in 2007 from Tegucigalpa, Honduras. In his first two years in the United States, Hernandez lived with Flores’ family in L.A.

As a devout Christian, Hernandez volunteered most of his time at his church where he helped organize musical events and activities. He met his wife at church.

An undated photo of Hernandez with his three children, who were in the car with him when he was shot.

(Courtesy of Nora Flores)

Flores cannot understand why someone would shoot her cousin.

“He’s the furthest thing from someone who could be confused for a gang member,” she said.

She’s aware that Hernandez’s life is going to change forever. She set up a GoFundMe campaign to help pay for his medical expenses.

Hernandez is the sole provider in his family. They are trying to keep his spirits up, but he’s also trying his best to comfort his family.

“He’s telling us it’s going to be OK, he’s trying to assure the children,” his wife said.

Flores said: “I’m just thinking, of all the people in the world, why did this have to happen to him?”

Business

Google employees stage sit-ins to protest company's contract with Israel

Dozens of Google employees held sit-ins Tuesday at the tech giant’s New York City and Sunnyvale, Calif., offices to protest the company’s work with Israel.

Google and Amazon have a cloud computing and artificial intelligence contract with the Israeli government and military, a deal known as Project Nimbus that is worth $1.2 billion.

The employees participating in the sit-ins wore shirts that said “Drop Project Nimbus” and a banner was hung that read, “No tech for genocide.”

Protesters sat in the office of Google Cloud Chief Executive Thomas Kurian on Tuesday and remained there for about 10 hours, according to the group.

They demanded Google and Amazon drop Project Nimbus and stop the “harassment, intimidation, bullying, silencing, and censorship” of Palestinian, Arab, Muslim Google workers who have expressed concerns about the company’s work in Israel and the Hamas war.

On Tuesday night, Google ordered the arrest of nine workers in Sunnyvale and New York, who were told they would be locked out of their accounts and offices and were not expected to return to work until contacted by HR, according to a statement from the No Tech for Apartheid campaign.

Officers arrived at a Google facility in Sunnyvale around 10:30 a.m. after getting a call from Google about the protest and saw around 80 participants, wrote Capt. Dzanh K. Le in an email on Tuesday night.

Most of the participants left the area around 12:45 p.m., with five protesters remaining, Le added. When the protesters refused to leave at around 6:30 p.m., they were “arrested without incident for criminal trespassing,” Le wrote.

In a statement, the group of workers who were arrested said they had asked to speak to the Google Cloud CEO but were denied .

“Google executives have ignored our concerns about our ethical responsibility for the impact of our technology as well as the damage to our workplace health and safety caused by this contract, and the company’s internal environment of retaliation, harassment, and bullying,” the workers said in a Wednesday statement. .

Four people were arrested for trespassing at the Google office in New York, according to the New York Police Department.

Google last month fired a worker who protested a speech by Google’s top executive in Israel at a conference in New York.

“As a Software Engineer in Google Cloud, it is horrifying to think that the code I write could be used by the Israeli Military in the first ever AI powered genocide,” said Google Cloud software engineer William Van Der Laar from Sunnyvale in a statement. “We did not come to Google to work on technology that kills. By engaging in this contract leadership has betrayed our trust, our AI Principles, and our humanity.”

Google, based in Mountain View, Calif., did not immediately respond to a request for comment.

Google told Time magazine this year that its Nimbus contract is for work related to Israeli government ministries such as finance, health, transportation and education.

“Our work is not directed at highly sensitive or classified military workloads relevant to weapons or intelligence services,” a Google spokesperson told Time.

Other tech workers, including at Amazon, have voiced concerns about their employers’ involvement in Project Nimbus.

The protests in the tech industry have escalated in the wake of Israel’s bombardment of the Gaza Strip in response to the Oct. 7 attack on Israel by Hamas-led militants in which about 1,200 people were killed and about 240 taken hostage.

More than 33,000 Palestinians in Gaza have been killed in Israel’s air and ground offensive, according to Gaza health officials.

Business

Column: With his Truth Social stock, Trump may be laughing all the way to the bank — but his investors have reason to weep

With their life savings, childrens’ college funds and their own retirement prospects at stake, most people probably view investing in stocks as a serious business. Now and then, however, the markets produce comedy gold.

Hello, Trump Media & Technology Group.

The owner of Truth Social, a social media platform exclusively hitched to Donald Trump, staged an initial public offering March 26 amid a torrent of speculation over how many billions the IPO would produce for Trump himself. In the event, the figure was a paper gain of about $5 billion for him, virtually pure profit.

It’s a scam. Just like everything he’s ever been involved in, it’s a con.

— Barry Diller on Trump and Trump Media

The cult of Trump had sent the shares soaring as high as $79.38 on that first day, valuing the company at about $9.5 billion. By the end of the day it had settled back to $57.99. Since then, it has mostly been on the schneid, falling steadily.

As I write, midway in the trading day Tuesday, the shares are quoted at $22.80, down more than 14% on the day. That brings the shares’ slide since they peaked at $79.38 on March 26 to about 70.2%.

Trump, who loves hyperbole, might revel in a three-week plunge that could be some sort of a record. Whether he would call it “beautiful,” one of his favorite superlatives, is another question.

The slide has pared the market value of Trump Media by more than $6 billion from its peak. Trump is still sitting on a paper holding worth more than $2 billion, but his outside investors, many of whom are small investors who bought at or near the top, have been been taken to the abattoir.

“I think they’re dopes,” the veteran entertainment executive Barry Diller said of Trump Media’s investors during a CNBC appearance on April 4.

That’s not to say, given the stock’s volatility, that it might not recover and end up in the green for the day, though whether it can recover the full 69.8% loss, even over time, is subject to doubt.

Still, the raw numbers, being right there for everyone to view in bright red, aren’t as interesting as the underlying grift. Let’s examine that.

It’s fair to say that few if any experienced investment professionals expect Trump Media to have staying power as a high-flying stock. I raised the most pertinent issues a few days before the IPO: The company had meager revenues and huge losses. It was to be taken public via a device — a special purpose acquisition company, or SPAC — that was often used to circumvent government rules for disclosures to investors.

Trump Media’s expected value of $5 billion at the IPO swore at common sense, or at any traditional standard of securities valuation. In short, Trump Media looked like any number of other Trump ventures, such as Trump University — all promise, no delivery.

“It’s a scam,” Diller told his CNBC interviewers. “Just like everything he’s ever been involved in, it’s a con.”

No one at Truth Social responded to my request for a comment about Diller’s remark.

Earlier, I asked whether anyone should believe in the valuation projections, and whether anyone in their right mind would invest. My answers were probably not, and probably not. That was conjecture, not investment advice.

After the IPO, however, more issues were disclosed that contributed to the stock’s precipitous slide. The company’s first annual report, issued April 1, incorporated an obligatory section on risk factors to be pondered by investors that included the traditional warnings about the costs of competition, the prospects of litigation, and the dangers of technology failures — and a couple that aren’t normally seen in corporate disclosures.

One covered the downsides of Trump Media’s linkage with Trump — that Truth Social faced “greater risks than typical social media platforms because of … the involvement of President Trump.” Those risks include “harassment of advertisers or content providers, increased risk of hacking of [Truth Social’s] platform, lesser need for Truth Social if First Amendment speech is no longer believed to be suppressed by other similar platforms, criticism of Truth Social for its moderation practices, and increased stockholder suits.”

The report made clear, if anyone was unaware of this, that the value of its brand “may diminish if the popularity of President Trump were to suffer,” as it would from “the death, incarceration, or incapacity of President Trump.”

Perhaps more telling was the company’s disclosure that it was not planning to “collect, monitor or report” the traditional metrics used by other social media platforms, such as Meta and X (formerly Twitter). Among those performance measures are “average revenue per user, ad impressions and pricing, … monthly and daily active users” — in other words, all the statistics that tell a social media company who, if anyone, is using it, and what their participation is worth in dollars and cents.

Having that information would only “divert” the company’s management, the report said, though it wasn’t clear about how management would fashion a strategy for the future if it doesn’t know where it is at present, including just how many users it has.

The annual report also updated Trump Media’s financial statements to cover the full year 2023: The platform lost more than $58 million on revenue of a bare $4.1 million. Previous disclosures had covered only the first nine months of 2023, when the company said it lost $49 million on $3.4 million in revenue.

On Monday, shareholders got another surprise. Trump Media said in a public filing that it planned to issue 40 million new shares to insiders (36 million of them to Trump himself) and that warrant holders were entitled to 21.5 million additional shares of stock, which could be expected to reach the open market almost immediately upon the warrants’ conversion.

That means existing shareholders are about to be heavily diluted, left with less of the company than they anticipated. The shares plunged more than 18% on Monday.

Who benefits from these maneuvers? Trump does. He is in effect the owner of 64.9% of the company, including the 36 million new shares; no one else owns more than 7.3%. For him this isn’t much of an investment; 36 million of his 114.7 million shares are a handout that didn’t require him to put up his own money. The rest were issued to him via the IPO in return for his interest in Trump Media as a private company.

Trump’s financial role in the founding of Truth Social in 2021 may have been minimal or nonexistent; Reuters reported in 2022 that most of the $38 million raised in the company’s first year came from businessmen who were political allies of Trump and from borrowings from unidentified lenders.

Trump has almost no ability to convert his shareholdings to cash in the near term, however. As a Trump Media insider, he is prevented from selling or borrowing against his shares for at least six months.

If and when he places any of his shares on the market, he would be selling into a declining market. Trump Media is the memiest of “meme stocks,” its value entirely divorced from financial fundamentals and based entirely on his involvement in the enterprise.

That places the value of his stake on a knife-edge. Any indication that he is reducing his commitment would almost certainly provoke a stampede for the exits among other shareholders. Trump would be racing to cash in before the value of his holdings reached the vanishing point.

Who are the other shareholders? According to a survey by the Washington Post, many are retail investors who believe that Trump’s touch is gold, or thought that buying his shares was a way to express faith in Trump and perhaps make some money on the side. At this moment, they are staring into the abyss.

-

News1 week ago

News1 week agoVideo: Election Officials Continue To Face Violent Threats

-

Movie Reviews1 week ago

Movie Reviews1 week agoSasquatch Sunset (2024) – Movie Review

-

Fitness1 week ago

This exercise has a huge effect on our health and longevity, but many of us ignore it

-

Science1 week ago

Science1 week agoThe Eclipse Across North America

-

World1 week ago

World1 week agoHope and anger in Gaza as talks to stop Israel’s war reconvene

-

Uncategorized1 week ago

Uncategorized1 week agoANRABESS Women’s Casual Loose Sleeveless Jumpsuits Adjustbale Spaghetti Strap V Neck Harem Long Pants Overalls with Pockets

-

News1 week ago

News1 week agoArizona Supreme Court rules that a near-total abortion ban from 1864 is enforceable

-

Finance1 week ago

Finance1 week agoSponsored: Six Ways to Use Robinhood for Investing, Retirement Planning and More