Business

In Search of Growth, Kohl’s Expands Sephora Shops to All Stores

Kohl’s mentioned on Thursday that it deliberate to open Sephora outlets in all of its 1,165 shops, positioning its magnificence unit for development.

By the tip of the 12 months, Sephoras will likely be in place at 600 Kohl’s places. In 2023, the plan is to open 250 extra. The Sephora areas are 2,500-square-feet shop-in-shops stocked with the merchandise one would discover at a full-line Sephora retailer. Kohl’s sees the partnership producing $2 billion in annual gross sales by 2025.

Kohl’s introduced its tie-up with Sephora in December 2020. On the time Sephora, a French multinational magnificence retailer, wished to re-establish a foothold in suburban areas, which it had gained in a earlier association with J.C. Penney. For Kohl’s, the partnership was a strategy to introduce extra customers to its model, particularly new and youthful ones.

Kohl’s has been underneath strain to enhance its monetary fortunes, and was pushed to promote itself by some activist traders. It fielded takeover bids this 12 months, and entered negotiations with Franchise Group, proprietor of The Vitamin Shoppe. Kohl’s terminated the talks in July, “in gentle of the present financing and retail setting, which has considerably deteriorated for the reason that starting of the method,” it mentioned. The chain’s shares are down greater than 30 p.c this 12 months.

Magnificence has been a mainstay class for customers all through the pandemic and retailers are searching for methods to bolster their private care choices. In February, Goal mentioned it was including 250 extra Ulta Magnificence outlets inside its places. The retailer mentioned it deliberate to open at the very least 800 in complete.

In interviews, Jean-André Rougeot, the chief government of Sephora Americas, and Michelle Gass, Kohl’s chief government, mentioned that their hopes had been taking part in out and that Kohl’s was gaining market share within the magnificence enterprise.

The primary 200 Kohl’s shops which have opened a Sephora shop-in-shop are seeing a gross sales elevate within the high-single-digit-percent vary relative to the Kohl’s shops that don’t function a Sephora, Ms. Gass mentioned. About half of Sephora transactions in Kohl’s shops included Kohl’s merchandise.

Mr. Rougeot mentioned that a million Kohl’s customers signed up for Sephora’s V.I.P. loyalty program throughout the first 12 months of the partnership. He mentioned some prospects who had stopped buying at Sephora had resumed by means of Kohl’s, attributing their return to the comfort of the division retailer places.

Kohl’s has invested closely within the partnership. Greater than half of Kohl’s capital spending this 12 months is directed towards establishing the Sephora places and reworking the shops that function them, Ms. Gass mentioned. Sephora’s title sits alongside Kohl’s on the surface of the buildings and the shop-in-shop is often on the entrance of the shop. Kohl’s, which has a partnership with Amazon that enables prospects to return Amazon merchandise at Kohl’s places, will now promote Sephora at these return counters.

The tie-up has elevated Kohl’s on-line gross sales for Sephora merchandise, too. “We expect we’re in a little bit of a snowball impact,” Mr. Rougeot mentioned.

Kohl’s reported quarterly earnings on Thursday that confirmed an 8.5 p.c fall in gross sales, and it sharply lowered its outlook for income and revenue for the 12 months. Like different retailers, it has confronted a glut of stock as customers present indicators of pulling again on discretionary spending as inflation stays excessive. On Thursday, it mentioned it was working to cut back undesirable merchandise and decrease bills as demand wanes.

Kohl’s mentioned that although there have been indicators customers had been pulling again on some objects, it was nonetheless seeing robust demand for magnificence and skincare merchandise.

“From a Kohl’s perspective we’re seeing these very robust outcomes regardless of these headwinds that prospects are dealing with round inflation and the macro pressures,” Ms. Gass mentioned. “We’re definitely feeling that in elements of our enterprise, however definitely Sephora and sweetness has confirmed to be very resilient.”

Business

Disney tech executive Aaron LaBerge leaves company after more than 20 years

Aaron LaBerge, chief technology officer of Disney Entertainment and ESPN, announced Monday that he is departing the Burbank-based media giant and will join casino and sports-betting company Penn Entertainment.

LaBerge will step into his new role as chief technology officer of Penn Entertainment in July, according to the Pennsylvania-based corporation, which offers integrated entertainment, sports content and casino gaming experiences. He has spent more than 20 years at Disney, where he specializes in technology and product for the company’s media divisions.

LaBerge will still be affiliated with ESPN because Penn Entertainment is behind ESPN Bet, the sports network’s gambling venture.

“I’m excited to join another talented team at PENN Interactive and lead our technology strategy,” LaBerge said in a statement.

“PENN Entertainment is at the forefront of the fast-changing gaming and sports media industry. I plan to use my experience from Disney and ESPN to help make ESPN BET an essential piece of the sports fan experience. Together, we’ll push the limits and redefine how fans interact with sports and gaming.”

In a memo to his team on Monday, LaBerge explained that he had decided to leave Disney for personal reasons related to his family .

“Disney is more than just a company to me; it’s been my home, my inspiration, and a part of the most rewarding chapters of my life, both personally and professionally,” LaBerge wrote in the memo.

“The true magic of Disney isn’t just in our stories or our technology but in each of you. Your passion, creativity, and brilliance have made my journey unforgettable.”

Disney chairmen Dana Walden, Alan Bergman and Jimmy Pitaro later informed staff that the search for LaBerge’s replacement is underway. Chris Lawson, executive vice president of content operations at Disney Entertainment and ESPN, will assume an interim leadership role in the months ahead of LaBerge’s exit.

Business

Column: The UAW sends a lightning bolt into anti-union states with a huge victory at a VW plant

Until Friday, the phrase “union victory at Chattanooga” could mean only one thing: the defeat of a Confederate army by forces under U.S. Grant at the Battle of Chattanooga in late November 1863.

No longer. On Friday, the United Auto Workers scored a decisive victory at a Volkswagen plant in Chattanooga, Tenn., as workers voted overwhelmingly to organize with the UAW.

The vote looks like a milestone. It was the UAW’s first victory at an auto plant in the Deep South, following two defeats — in 2014 and 2019 — at the same plant. It comes on the heels of the UAW’s success in negotiating impressive new contracts with the Big Three domestic automakers in October.

The real importance of this election is not just the organizing of this factory. It’s that it announces the South is open to unions.

— Labor historian Erik Loomis

The vote opens the door to further votes and organizing drives across the region, where political leaders have kept unions weak in part through anti-union right-to-work laws — all 14 Deep South states, as well as 12 others, have those laws. Next on the schedule is a vote by 5,000 workers at a Mercedes plant in Alabama, scheduled to take place May 13-17.

“The real importance of this election is not just the organizing of this factory,” says labor historian Erik Loomis. “It’s that it announces the South is open to unions…. This has been the greatest struggle for the American labor movement for more than a century. A serious breakthrough in the South is now possible.”

The vote also represents a strong rebuke to the GOP political establishment in the South. Indeed, it turns the history of regional auto worker organizing on its head. In 2014, it may be remembered, Tennessee’s GOP establishment pulled out the stops to discourage workers at the Chattanooga plant from organizing with the UAW.

VW was willing to accept unionization, with an eye toward replicating the labor-management “works councils” common among manufacturing companies at its home in Germany. (“Volkswagen considers its corporate culture of works councils a competitive advantage,” a member of VW’s board had told the Associated Press.)

In response, then-Gov. Bill Haslam threatened the company with retribution, declaring that Tennessee would withdraw incentives for Volkswagen if the UAW was voted in.

Then-GOP Sen. Bob Corker, a former Chattanooga mayor, flew down from Washington to voice an almost certainly specious claim that VW executives had “assured” him that the company would open a new SUV manufacturing line at the plant — if the workers turned the UAW down. A local VW executive disputed that.

With shocking cynicism, Corker co-opted the language of political resistance to discourage workers from voting in the union, stating that if the UAW won the vote, “it’s going to be something we can overcome — we will overcome.”

I marveled at the time that the ghost of Pete Seeger, who had turned a couple of traditional gospel songs into the civil rights anthem “We Shall Overcome,” didn’t rise from the grave and impale Corker on a lightning bolt.

Corker also perverted another protest slogan into an attack on workers by declaring, “the whole world is watching.”

The 2014 organizing campaign failed on a 626-712 vote. After the UAW filed a protest with the National Labor Relations Board over the interference by Haslam, Corker and their cronies, the 2019 revote was held. It was another defeat for the union, but narrower, with 48% of the votes in favor, compared with 46% in 2014.

This time around, the vote was 2,628 in favor versus 985 against — a 72.7% majority.

Early signs that the Chattanooga workers would vote to unionize didn’t stop GOP politicians from trying to place their thumbs on the scale. In a joint statement issued the day before voting began, Tennessee’s current GOP governor, Bill Lee, and the governors of Alabama, Mississippi, Georgia, South Carolina and Texas decried what they hypocritically called “the unionization campaign driven by misinformation and scare tactics that the UAW has brought into our states.”

The governors noted that all three automakers that signed the October contracts with the UAW had announced layoffs since then. That’s true, but it was a lie to ascribe the layoffs to the union contracts: In each case, the companies linked them to an unexpected slowdown in the market for electric vehicles.

What the governors didn’t mention — an inadvertent oversight, you can be sure — several of the non-union foreign automakers with plants in the South, such as Mercedes, Tesla and BMW, all of which are being targeted by the UAW, have also announced layoffs.

Perhaps more to the point, in the wake of the Big Three contract settlements, Toyota, Honda, Nissan and Subaru all announced raises of as much as 11% for their workers — plainly a demonstration that higher pay at unionized companies ripples into the nonunion sector of an industry. All those companies except Subaru have plants in states represented by the governors who issued the statement; Subaru’s only U.S. plant is in Lafayette, Ind.

“In America,” the governors wrote, “we respect our workforce and we do not need to pay a third party to tell us who can pick up a box or flip a switch.” They added, “when employees have a direct relationship with their employers, that makes for a more positive working environment. They can advocate for themselves and what is important to them without outside influence.”

Students of anti-union rhetoric will recognize this spiel as drawn directly from the playbook of intransigently anti-union employers such as Starbucks, including the assertions that union representation is inimical to the smooth operation of a workplace and that unions interfere with the employee-employer relationship.

As almost any experienced worker knows, “direct contact” between the rank-and-file and management almost never works out to the advantage of the workers unless they have the leverage that comes from collective action. The governors’ claim that employees can successfully “advocate for themselves” is virtually pure myth.

The governors also may have failed to read the room, as the saying goes. “The demographics of the South are different than they were 10 years ago,” Loomis told me. “More Latinos and more people moving from the North has been transformational to the South generally — the shift of politics in Georgia due to the expansive growth of Atlanta is one example. Charlotte has become a massive destination for young Black professionals, for another. The South simply isn’t as different from the rest of the nation as it used to be.”

Nor should one overlook the distinct change in labor policies at the federal level. Joe Biden’s stature as possibly the most pro-labor president in American history has been widely noticed. He is the only president to walk a union picket line, as he did during the UAW contract negotiations; he has been sticking with Julie Su, his nominee as secretary of Labor against ferocious opposition from Big Business; and his National Labor Relations Board has fulfilled its role as a guardian of collective bargaining rights.

Whether NLRB oversight of the Chattanooga vote tamped down the company’s efforts to undermine the vote isn’t clear, but it couldn’t have hurt.

The UAW’s success in its contract negotiations may emerge as a powerful argument in favor of organizing at other auto plants. There may be some defeats in the South lurking on the horizon, but there may also be further successes.

It’s worth recalling what happened after Grant’s victory in Chattanooga in 1863. Following the nearly simultaneous Union victories of July 1863 at Vicksburg, Miss., and Gettysburg, Pa., Chattanooga tightened the noose on the Confederacy, opening the door to Sherman’s march to the sea in 1864 and the end of the Confederacy.

Last week’s vote in Chattanooga might, just might, be an equivalent turning point in the long war for worker rights and welfare.

Business

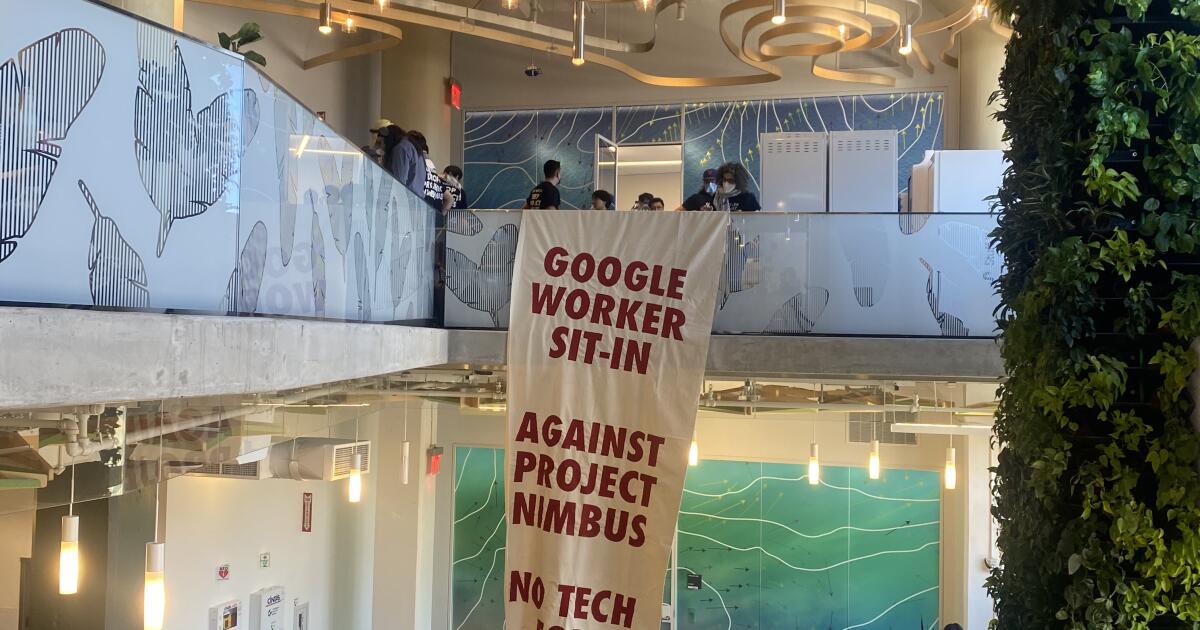

Google fires 28 employees who protested Israel cloud contract

Google has terminated 28 employees after dozens of workers participated in sit-ins inside company offices this week to protest the tech giant’s work in Israel amid the war against Hamas in Gaza.

The protests, organized by the No Tech for Apartheid campaign, raised concerns about Google and Amazon’s $1.2-billion cloud computing contract with the Israeli government and military. The campaign is demanding that Google and Amazon drop the effort, known as Project Nimbus.

The advocacy group staged protests and sit-ins Tuesday at Google offices in New York and Sunnyvale, Calif., where nine Google employees were arrested for trespassing. The campaign said the firings included people who did not directly participate in the sit-in protests.

Google said the employees had violated company policy.

In a letter to Google staff, Chris Rackow, Google’s vice president of global security, said the workers were terminated after an internal investigation, adding that their actions ran afoul of the company’s code of conduct and harassment rules.

“They took over office spaces, defaced our property, and physically impeded the work of other Googlers,” Rackow wrote in a memo obtained by the New York Post, which first reported the firings. “Their behavior was unacceptable, extremely disruptive, and made co-workers feel threatened.”

In a statement on Thursday night, Google said all of the 28 people whose employment was terminated was “definitively involved in disruptive activity inside our buildings.”

“The groups were live-streaming themselves from the physical spaces they had taken over for many hours, which did help us with our confirmation,” Google said. “And many employees whose work was physically disrupted submitted complaints, with details and evidence. So the claims to the contrary being made are just nonsense.”

The protest group said the workers “have the right to peacefully protest about terms and conditions of our labor.”

“In the three years that we have been organizing against Project Nimbus, we have yet to hear from a single executive about our concerns,” the No Tech for Apartheid campaign said in a statement. “These firings were clearly retaliatory.”

The group said it plans to continue organizing until Google drops the contract.

The protests in the tech industry have escalated in the wake of Israel’s bombardment of the Gaza Strip, which began in response to the Oct. 7 attack on Israel by Hamas-led militants in which about 1,200 people were killed and about 240 taken hostage.

More than 33,000 Palestinians in Gaza have been killed in Israel’s air and ground offensive, according to Gaza health officials.

Google has said that its technology is used to support numerous governments around the world, including Israel’s, and that the Nimbus contract is for work running on its commercial cloud network, with the Israeli government ministries agreeing to comply with Google’s terms of service and acceptable use policy.

“This work is not directed at highly sensitive, classified, or military workloads relevant to weapons or intelligence services,” Google said in a statement.

-

News1 week ago

News1 week agoCross-Tabs: April 2024 Times/Siena Poll of Registered Voters Nationwide

-

World1 week ago

World1 week agoIran launches dozens of drones at Israel

-

Politics1 week ago

Politics1 week agoWhite House says US support for Israel is 'ironclad,' will 'support their defense' amid Iran attack

-

News1 week ago

News1 week agoWyoming Democratic Caucus Results

-

News1 week ago

News1 week agoCross-Tabs: April 2024 Times/Siena Poll of the Likely Electorate

-

Politics1 week ago

Politics1 week agoNine questions about the Trump trial, answered

-

World5 days ago

World5 days agoIf not Ursula, then who? Seven in the wings for Commission top job

-

World1 week ago

World1 week agoHungary won't rule out using veto during EU Council presidency