Business

Boeing is looking to jettison the space business. Why it might hold on to its El Segundo satellite operation

With its manufacturing practices under scrutiny, its machinists on strike and losses piling up, Boeing is said to be considering selling parts of its fabled space business. But few industry analysts think Boeing will put its extensive El Segundo satellite operations on the table.

New Boeing Chief Executive Kelly Ortberg said during a recent earnings call that the aerospace giant was considering shedding assets outside of the company’s core commercial aviation and defense businesses, adding that Boeing was better off “doing less and doing it better than doing more and not doing it well.”

That could mean that Boeing sees no future for its troubled Starliner spacecraft, which was developed to service the International Space Station. The Arlington, Va., aerospace giant also has been trying to exit its United Launch Alliance joint launch venture with Lockheed Martin. Both programs face stiff competition from Elon Musk’s SpaceX, which recently announced it was moving its headquarters from Hawthorne to Brownsville, Texas.

But any asset sale is not expected to encompass Boeing’s satellite manufacturing operations in El Segundo, which include a 1-million-square-foot plant with several thousand workers it acquired in 2000 with its purchase of Hughes Electronics Corp.’s space and communications business.

“It’s not a booming growth business, but there’s no reason for Boeing to get out anytime soon,” said Marco Caceres, an aerospace analyst at Teal Group, noting the continuing demand for the large satellites made at the facility despite changes in the industry.

Shedding parts of it space business would be a landmark decision for Boeing, which has deep ties to the space program in Southern California — where it has built rockets, the X-37 space plane and components for the space station.

Ortberg’s comments come amid manufacturing concerns over its key 737 commercial jet program and a machinists strike that is estimated to be costing $50 million a day. Boeing raised $21 billion in a stock sale this week to shore up its balance sheet.

Boeing also has been the target of multiple whistleblower lawsuits that have alleged lax safety and manufacturing practices that resulted in quality-control issues.

The Wall Street Journal first reported that Boeing was considering selling parts of its space business last week. A Boeing spokesperson said the company “doesn’t comment on market rumors or speculation.”

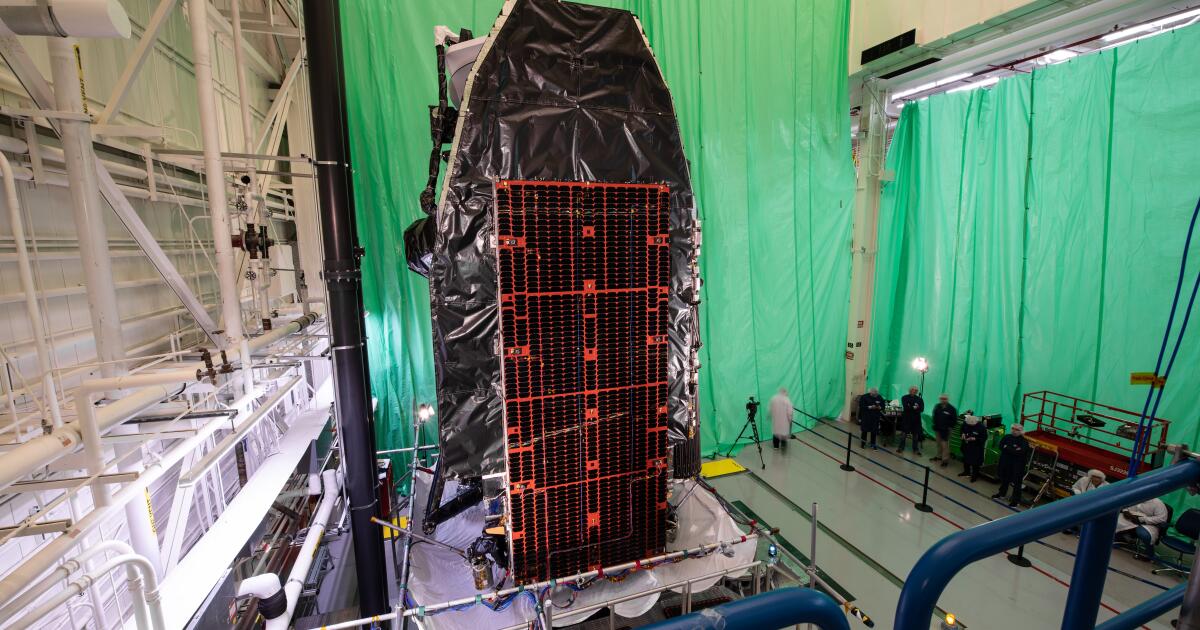

The El Segundo satellite plant makes large satellites for commercial, government and military customers, including the O3b mPOWER communications satellite for SES, a Luxembourg telecommunications company. Other programs include a $440-million defense contract that Boeing was awarded in March to build another Wideband Global Satcom satellite, which provide fast and secure communications for the U.S. and its allies.

Caceres said manufacturing large satellites remains lucrative for now, though the trend has been for networks of thousands of smaller satellites, such as SpaceX’s Starlink broadband network.

“It’s still a good business but it’s going to be diminished, because it really is these big, mega-constellation systems that are the future,” he said.

In 2018, Boeing acquired a maker of small satellites called Millennium Space Systems, which also is based in El Segundo and whose operations have been partially integrated with the company’s existing plant. The company has received U.S. defense contracts for satellites to detect new threats such as hypersonic missiles.

Other Boeing space businesses in the region expected to survive any restructuring include Spectrolab, a Sylmar subsidiary that makes solar cells for satellites and other space applications. Boeing also is expected to continue its participation in the Space Launch System, a massive rocket developed in Huntsville, Ala., that NASA plans to use to send astronauts back to the moon.

The clearest choice for a possible sale or program closure, analysts agree, is the Starliner capsule built to service the International Space Station with crews and supplies. The spacecraft was manufactured at the Kennedy Space Center in Florida and launches from nearby Cape Canaveral Space Force Station.

Boeing was awarded a $4.6-billion contract in 2014 to develop the craft and has been hit with some $1.5 billion in cost overruns, but the vehicle has yet to be certified. Meanwhile, SpaceX was awarded a smaller contract to develop a crewed capsule, based on its existing Cargo Dragon capsule, and that craft has made more than a dozen trips to the station.

In a blow to Boeing, NASA decided in August to have SpaceX return two astronauts brought to the space station by Starliner in June after the capsule developed propulsion problems while docking on its third test flight. Although the Starliner returned remotely in September, NASA and Boeing are still investigating what went wrong.

Also seen as expendable is Boeing’s participation in the United Launch Alliance, a joint venture it formed in 2006. It claims a perfect mission success rate in more than 150 military and commercial launches. ULA is based in Denver and launches from Cape Canaveral and Vandenberg Space Force Base in Santa Barbara County.

The venture introduced its new Vulcan Centaur rocket this year, which is partly reusable and lowers launch costs to about $110 million. It is more powerful than its SpaceX competitor, the Falcon 9, but that rocket has a fully reusable booster and flight costs starting at less than $70 million.

The space industry has been rife with speculation about who might acquire ULA — Jeff Bezos’ Blue Origin space company has been rumored as a possible buyer — but no deal has emerged, possibly because the price is too high, said Laura Forczyk, executive director of space industry consulting firm Astralytical.

Although the business is not as strong as it used to be, ULA’s reliability, a shortage of launch vehicles and the new rocket’s technical advances means it can still attract business, she said, adding: “There’s just so much demand for launch services.”

Business

Commentary: Trump Media’s financial report revives doubts for investors

So much Trump-related news has appeared lately on the airwaves and in web pixels — what with Iran and Epstein and Minnesota and so on — that inevitably a nugget will fall between the cracks.

That seems to have been the fate of the most recent annual financial report of Trump Media and Technology Group, which covered calendar year 2025 and was issued Friday.

Trump Media, which is 52% owned by Donald Trump and trades on Nasdaq with a ticker symbol based on his initials (DJT), is the holding company for Trump’s social media platform, Truth Social.

The value of TMTG’s brand may diminish if the popularity of President Donald J. Trump were to suffer.

— A risk factor disclosed by Trump Media

The annual financial disclosure has garnered minimal press coverage. That’s a pity, because it makes fascinating reading, though not in a good way.

Here are the top and bottom lines from the 10-k annual report: Trump Media lost $712.1 million last year on revenue of about $3.7 million. That’s quite a bit worse than its performance in 2024, when it lost $409 million on revenue of about $3.6 million. The company attributed most of the flood of red ink to “loss from investments,” of which more in a moment.

Truth Social isn’t an especially strong keystone of this operation. The platform is chiefly an outlet for Trump’s social media ramblings and the occasional official White House statements. But no one has to sign in to Truth Social to see them — they’re almost invariably picked up by the news media or reposted by users on other platforms such as X.

That might explain Truth Social’s relatively scrawny user base. The platform is estimated to have about 2 million active users, according to the analytical firm Search Logistics. By comparison, X has about 450 million monthly active users and Facebook has more than 2.9 billion.

It’s no mystery, then, why TMTG disdains “traditional performance metrics like average revenue per user, ad impressions and pricing, or active user accounts, including monthly and daily active users,” according to its annual report.

Relying on those metrics, which are used to judge TMTG’s social media rivals, “might not align with the best interests of TMTG or its stockholders, as it could lead to short-term decision-making at the expense of long-term innovation and value creation.”

Instead, the company says it should be evaluated based on “its commitment to a robust business plan that includes introducing innovative features, new products, new technologies.” But it also acknowledges that, at its heart, TMTG is a proxy for “the reputation and popularity of President Donald J. Trump.” The company warns that “the value of TMTG’s brand may diminish if the popularity of President Donald J. Trump were to suffer.”

How has that played out in real time? Trump Media notched its highest closing price as a public company, $66.22, on March 27, 2024, the day after its initial public offering. In midday trading Monday, the shares were quoted at $11.08, for a loss of 83% since the IPO.

One can’t quibble with stock market price quotes; nor can one finagle annual profit and loss statements, at least not without receiving questions, and perhaps lawsuit complaints, from attentive investors and the Securities and Exchange Commission.

In recent months, TMTG has engaged in a number of baroque financial transactions.

In May, the company announced that it was planning to raise $3.5 billion from institutions to invest in bitcoin, with the money to come from issues of common and preferred shares. The goal was to climb onto the cryptocurrency train, which Trump himself was fueling by, among other things, issuing an executive order promoting the expansion of crypto in the U.S. and denigrating enforcement efforts by the Biden administration as reflecting a “war on cryptocurrency.”

Under Trump, federal regulators have dropped numerous investigations related to cryptocurrencies. Trump has also talked about creating a government crypto strategic reserve, which would entail large government purchases of bitcoin and other cryptocurrencies; a March 3 announcement on that subject briefly sent bitcoin prices soaring by nearly 20%, though they promptly fell back.

Then there’s TMTG’s relationship with Crypto.com, a Singapore-based crypto “service provider” best known to Angelenos unfamiliar with the crypto world as the firm with naming rights to the Los Angeles arena that hosts the NBA Lakers and Clippers, WNBA Sparks and NHL Kings.

In August, Crypto.com and TMTG announced a deal in which TMTG would pursue a crypto treasury strategy consisting mostly of Cronos tokens, a cryptocurrency sponsored by Crypto.com. The initial infusion would consist of 6.4 billion Cronos valued at $1 billion, or about 15.8 cents per Cronos.

As of Dec. 31, TMTG said in its 10-K, it owned 756.1 million Cronos, acquired at a cost of about $114 million, or 15 cents each. By year’s end, they were worth only about nine cents each, for a paper loss of about $46 million. In trading this week, Cronos was quoted at about 7.6 cents, producing a paper loss for TMTG of about $56.5 million, or roughly half the investment.

The financial maneuvering involved in this trade is a little dizzying. The initial transaction was a 50% stock, 50% cash trade in which Crypto.com bought $50 million in TMTG stock and TMTG bought $105 million in Cronos. Who gained in this deal? It’s almost impossible to say.

Crypto.com did gain, if not purely in cash, then arguably through the Trump administration’s good graces.

On March 27, the SEC formally closed an investigation of the company that it had launched during the Biden administration, when the agency was headed by a known crypto skeptic, Gary Gensler. Trump appointed a crypto-friendly regulator, Paul Atkins, as Gensler’s successor.

It’s reasonable to note that as a business model, crypto treasuries have been in vogue over the last year or so, allowing investors to play the crypto market without all the complexities of actually buying and holding the digital assets by buying shares in treasury companies.

I asked Crypto.com whether the steady decline in Cronos’ price suggested that the hookup with TMTG wasn’t bearing fruit. “The fluctuation in value during this time period is consistent with the entire crypto market, which is typical in a bear market,” company spokeswoman Victoria Davis told me by email.

Davis also asserted that the SEC’s investigation of the company had been closed by Gensler, “not the current administration” (i.e., Trump). That’s misleading, at best. Gensler put the investigation on hold after the 2024 election, when it became clear that Trump was going to be in charge.

Crypto.com’s March 27 announcement of the formal end of the case attributed the action to “the current SEC leadership” and blamed the case on “the previous administration.” I asked Davis to explain the discrepancy but got no reply.

TMTG, like Crypto.com, attributed the decline in Cronos’ value to the secular bear market raging in the entire cryptocurrency space, a reflection of “temporary price swings across the crypto market,” said TMTG spokeswoman Shannon Devine. She said the price decline “will not diminish our enthusiasm for the enormous potential of the [CRONOS] ecosystem.”

Trump’s coziness with crypto companies hasn’t gone unnoticed by Democrats on the House Judiciary Committee, who issued a scathing report on the topic in November. (The White House scoffed at the report, saying in response to the report that Trump “only acts in the best interests of the American public.”)

In mid-December, TMTG launched yet another remaking — this time, plunging into the business of fusion power. The instrument is TAE Technologies, a Foothill Ranch-based company working to develop the technology of nuclear fusion as a clean energy source. According to a Dec. 18 announcement, TMTG and TAE will merge, creating what they say is a $6-billion company.

According to the announcement, TMTG will contribute $200 million to the merged company when the deal closes in mid-2026, and an additional $100 million subsequently. Following the merger, TMTG said last month, it will consider spinning off Truth Social into a new publicly traded company.

These arrangements are murky. TAE is privately held and the value of Truth Social is conjectural at best, so TMTG shareholders could be hard-pressed to assess their gains or losses from the merger and spin-off.

What makes them even murkier is the speculative nature of fusion as an electrical power source. Although numerous companies have leaped into the field — and TAE, which has been backed by Alphabet, the parent of Google, is among the oldest — none has shown the capability of generating electrical power at commercial scale with the elusive technology.

Although some researchers say that fusion could become a technically and economically feasible power source within 10 years, only in 2022 did fusion researchers (at Lawrence Livermore National Laboratory) achieve the goal of using fusion to produce more energy than is required to sustain a reaction. They were able to do so only for less than a billionth of a second.

Others working on the technology have expressed doubts that fusion could become a viable power source before the 2040s. The technical challenges, including how to convert the energy produced by a fusion reactor into electricity, remain daunting.

All this points to the fundamental question of what TMTG is supposed to be. TMTG’s original mission, according to its own publicity statements, was to build Truth Social into an alternative social media platform “to end Big Tech’s assault on free speech by opening up the Internet.”

Spinning off Truth Social would place that goal on the side. TMTG is on its way too becoming a hodgepodge of crypto, fusion and other investments selected without regard to whether they fit together or are even achievable. The only constant is Trump himself.

If you want to invest in him, TMTG may be the best way to do it. But judging from its latest financial disclosure, that’s not the same as being a good way to do it.

Business

California gas is pricey already. The Iran war could cost you even more

The U.S. attack on Iran is expected to have an unwelcome impact on California drivers — a jump in gas prices that could be felt at the pump in a week or two.

The outbreak of war in the Middle East, which virtually closed a key Persian Gulf shipping lane, spiked the price of a barrel of Brent crude oil by as much as $10, with prices rising as high as $82.37 on Monday before settling down.

The price of the international standard dictates what motorists pay for gas globally, including in California, with every dollar increase translating to 2.5 cents at the pump, said Severin Borenstein, faculty director of the Energy Institute at UC Berkeley’s Haas School of Business.

That would mean drivers could pay at least 20 cents more per gallon, though how much damage the conflict will do to wallets remains to be seen.

“The real issue though is the oil markets are just guessing right now at what is going to happen. It’s a time of extreme volatility,” Borenstein said. “We don’t know whether the war will widen or end quickly, and all of those things will drive the price of crude.”

President Trump has lauded the reduction of nationwide gas prices as a validation of his economic agenda despite worries about a weak job market and concerns of persistent inflation.

The upheaval in the Middle East could be more acutely felt in the state.

Californians already pay far more for gas than the rest of the country, with the average cost of a gallon of regular at $4.66, up 3 cents from a week ago and 30 cents from a month ago, according to AAA. The current nationwide average is about $3 per gallon.

The disruption in international crude markets also comes as refiners are switching to producing California’s summer-blend gas, which is less volatile during the state’s hot summers. The switch can drive up the price of a gallon of gas at least 15 cents.

The prices in California are largely driven by higher taxes and a cleaner, less polluting blend required year-round by regulators to combat pollution — and it’s long been a hot-button issue.

The politics were only exacerbated by recent refinery closures, including the Phillips 66 refinery in Wilmington in October and the idling and planned closure of the Valero refinery in Benicia, Calif., which reduced refining capacity in the state by about 18%.

California also has seen a steady reduction in its crude oil production, making it more reliant on international imports of oil and gasoline.

In 2024, only 23.3% of the crude oil refined in the state was pumped in California, with 13% from Alaska and 63% from elsewhere in the world, including about 30% from the Middle East, said Jim Stanley, a spokesperson for the Western States Petroleum Assn.

“We could see a supply crunch and real price volatility” if the Middle East supply is interrupted, he said.

The Strait of Hormuz in the Persian Gulf, through which about 20% of the world’s oil passes, was virtually closed Monday, according to reports. Though it produces only about 3% of global oil, Iran has considerable sway over energy markets because it controls the strait.

Also, in response to the U.S. attack, Iran has fired a barrage of missiles at neighboring Persian Gulf states. Saudi Arabia said it intercepted Iranian drones targeting one of its refinery complexes.

California Republicans and the California Fuels & Convenience Alliance, a trade group representing fuel marketers, gas station owners and others, have blamed Gov. Gavin Newsom’s policies for driving up the price of gas.

A landmark climate change law calls for California to become carbon neutral by 2045, and Newsom told regulators in 2021 to stop issuing fracking permits and to phase out oil extraction by 2045. He also signed a bill allowing local governments to block construction of oil and gas wells.

However, last year Newsom changed his stance and signed a bill that will allow up to 2,000 new oil wells per year through 2036 in Kern County despite legal challenges by environmental groups. The county produces about three-fourths of the state’s crude oil.

Borenstein said he didn’t expect that the new state oil production would do much to lower gas prices because it is only marginally cheaper than oil imported by ocean tankers.

Stanley said the aim of the law was to support the Kern County oil industry, which was facing pipeline closures without additional supplies to ship to state refineries.

Statewide, the industry supports more than 535,000 jobs, $166 billion in economic activity and $48 billion in local and state taxes, according to a report last year by the Los Angeles County Economic Development Corp.

Bloomberg News and the Associated Press contributed to this report.

Business

Block to cut more than 4,000 jobs amid AI disruption of the workplace

Fintech company Block said Thursday that it’s cutting more than 4,000 workers or nearly half of its workforce as artificial intelligence disrupts the way people work.

The Oakland parent company of payment services Square and Cash App saw its stock surge by more than 23% in after-hours trading after making the layoff announcement.

Jack Dorsey, the co-founder and head of Block, said in a post on social media site X that the company didn’t make the decision because the company is in financial trouble.

“We’re already seeing that the intelligence tools we’re creating and using, paired with smaller and flatter teams, are enabling a new way of working which fundamentally changes what it means to build and run a company,” he said.

Block is the latest tech company to announce massive cuts as employers push workers to use more AI tools to do more with fewer people. Amazon in January said it was laying off 16,000 people as part of effort to remove layers within the company.

Block has laid off workers in previous years. In 2025, Block said it planned to slash 931 jobs, or 8% of its workforce, citing performance and strategic issues but Dorsey said at the time that the company wasn’t trying to replace workers with AI.

As tech companies embrace AI tools that can code, generate text and do other tasks, worker anxiety about whether their jobs will be automated have heightened.

In his note to employees Dorsey said that he was weighing whether to make cuts gradually throughout months or years but chose to act immediately.

“Repeated rounds of cuts are destructive to morale, to focus, and to the trust that customers and shareholders place in our ability to lead,” he told workers. “I’d rather take a hard, clear action now and build from a position we believe in than manage a slow reduction of people toward the same outcome.”

Dorsey is also the co-founder of Twitter, which was later renamed to X after billionaire Elon Musk purchased the company in 2022.

As of December, Block had 10,205 full-time employees globally, according to the company’s annual report. The company said it plans to reduce its workforce by the end of the second quarter of fiscal year 2026.

The company’s gross profit in 2025 reached more than $10 billion, up 17% compared to the previous year.

Dorsey said he plans to address employees in a live video session and noted that their emails and Slack will remain open until Thursday evening so they can say goodbye to colleagues.

“I know doing it this way might feel awkward,” he said. “I’d rather it feel awkward and human than efficient and cold.”

-

World6 days ago

World6 days agoExclusive: DeepSeek withholds latest AI model from US chipmakers including Nvidia, sources say

-

Massachusetts6 days ago

Massachusetts6 days agoMother and daughter injured in Taunton house explosion

-

Denver, CO6 days ago

Denver, CO6 days ago10 acres charred, 5 injured in Thornton grass fire, evacuation orders lifted

-

Louisiana1 week ago

Louisiana1 week agoWildfire near Gum Swamp Road in Livingston Parish now under control; more than 200 acres burned

-

Oregon4 days ago

Oregon4 days ago2026 OSAA Oregon Wrestling State Championship Results And Brackets – FloWrestling

-

Florida3 days ago

Florida3 days agoFlorida man rescued after being stuck in shoulder-deep mud for days

-

Technology1 week ago

Technology1 week agoArturia’s FX Collection 6 adds two new effects and a $99 intro version

-

News1 week ago

News1 week agoVideo: How Lunar New Year Traditions Take Root Across America